Declare related-party transactions (LGs) according to Decree 132/2020/ND-CP It is not only a simple administrative obligation but also one of the most important “legal shields” for businesses to protect themselves against the risks of tax assessment and in-depth inspection. Mastering the nature of GDLK, correctly understanding the scope of linkage, fully implementing Form 01 as well as building a Pricing Profile (National Profile – Global Profile) is the key to ensuring compliance with the arm’s length principle (ALP) and demonstrating international standard tax management capacity.

In the context of tax authorities increasingly strengthening transfer pricing control, enterprises need to proactively build a long-term transfer pricing management system, from reviewing related relationships, standardizing contracts, optimizing pricing methods, to periodically updating benchmarking according to OECD standards. This is not only compliance, but also a strategy to protect profit margins, stabilize cash flow and enhance reputation in the eyes of investors, banks and global partners.

Legal basis and scope of application

Arm's Length Principle (ALP)

The core principle governing all activities related to determining transfer pricing is the Independent Transaction Principle (ALP).

The Uncontrolled Transaction Principle stipulates that the price of a related party transaction must be equivalent to the price of a transaction made between independent (unrelated) parties under equivalent conditions. This principle is the basis for the Tax Authority to assess whether the declaration of related party transactions by an enterprise is reasonable and not aimed at shifting profits to lower tax regions.

Details about the Affiliated Parties

Decree 132/2020/ND-CP expands the scope of identifying Related Parties compared to previous regulations, laying the foundation for the obligation to declare related-party transactions of enterprises. An enterprise must declare related-party transactions if it has at least one of the 10 relationships classified into the following 4 groups during the tax period:

Group 1: Capital Ownership Relations

To determine whether an enterprise is within the scope of related-party transactions under Decree 132/2020/ND-CP or not, the factors of ownership and management rights are always the key basis. Related relationships are often identified through the level of direct or indirect capital contribution, along with the ability of one entity to control the management, finance or business strategy of the other entity. The table below summarizes the most typical cases, helping enterprises accurately assess whether they have related-party transactions and must fulfill the obligation to declare related-party transactions according to current legal regulations or not.

| Case | Describe | For example |

| Direct ownership | One enterprise directly holds 25% of the other enterprise's capital contribution. | Company A owns 35% of the charter capital of Company B, resulting in A and B being related parties. |

| Indirect ownership | Both enterprises have 25% of contributed capital directly held by the same third party. | Company C owns 45% of capital of Company X and 37% of capital of Company Y. This leads to X and Y being Associated Parties. |

| Executive and personnel relations | A third party holds 25% of capital contribution of an enterprise and is the largest shareholder or has the right to decide on the management of the remaining enterprise. | A owns 53% B; B owns 65% C. A indirectly owns 33% C, resulting in A and C being related parties. |

Real life situation: Declaration of related-party loan transactions by the Director (or a member of the Board of Directors)

A loan from the Director (or a person related to the Director) to the company, even if interest-free, still constitutes an Associated Transaction under Article 5 of Decree 132/2020/ND-CP. Enterprises must still declare the Associated Transaction (Form 01) and must comply with the Independent Transaction principle (determining the market price for the loan) to calculate deductible interest expenses, even if there is no actual interest.

Group 2: Relationships on management control and borrowing

To clarify how businesses determine whether they are subject to declaration of related-party transactions under Decree 132/2020/ND-CP, especially in the group of management control relationships and loan relationships, the content below is presented in a visual format to help businesses grasp the true nature. The summary table will help businesses understand the legal conditions, how to analyze practices and methods of reviewing related-party relationships accurately, thereby being more proactive in managing tax risks and complying with the requirement to declare related-party transactions annually.

| Case | Describe | Analysis and examples |

| Key Executive Relationships | Two enterprises are under the management or control of key personnel by the same individual or organization, where: Occupy over 50% of the total number of Board of Directors members or hold key management positions with the highest decision-making power. | For example: Individual A is concurrently the General Director of Company X and Chairman of the Board of Directors of Company Y. If these positions create control or majority in the leadership, X and Y are considered related parties. Meaning: Personnel control is one of the most important ways to identify a business with related-party transactions, as it exerts direct influence over financial policies, strategies and business decisions between the two parties. |

| Loan or loan guarantee | An enterprise guarantees or lends to another enterprise when it simultaneously satisfies two conditions: Loan or guarantee from 25% equity capital of the capital recipient; The loan or guarantee accounts for over 50% of the total medium and long-term debt of the capital recipient. | Note: If the loan comes from an independent credit institution (bank), it does not create a affiliated relationship, unless the loan is guaranteed by an affiliated third party. Meaning: This is a form of association through financial dependence, allowing the lender or guarantor the ability to influence the activities of the recipient. |

From the above table, businesses can quickly identify important cases of related relationships related to personnel control and loan relationships, thereby correctly and fully determining whether they are subject to declaration of related-party transactions according to regulations. Understanding these criteria not only helps businesses comply with Decree 132/2020/ND-CP accurately but also minimizes the risk of being taxed, collected and fined. At the same time, this is also an important foundation to improve transparency in financial management and control long-term tax risks.

Group 3: Economics and Intangible Assets

To clarify how to identify related-party transactions arising from economic dependence and intangible assets, enterprises need to master the criteria according to Decree 132/2020/ND-CP. In the process of declaring related-party transactions, correctly understanding the nature of this relationship is a prerequisite to ensure compliance and limit risks during tax inspection. The table below summarizes 3 typical cases, including identification criteria, detailed descriptions and illustrative examples, helping enterprises easily apply them to actual operations.

| Case | Criteria | Describe | For example |

| Depends on raw material source or output | Enterprises supplying more than 50% of input materials or more than 50% of output products to other enterprises. | Transaction value is calculated based on the largest transaction value in the fiscal year. | Company Z is the exclusive supplier of materials to Company Q, with sales accounting for 65% of Q's total raw material costs. Z and Q are affiliated parties. |

| Use of Intangible Assets | Two businesses jointly use intangible assets and have a third party involved in control or decision-making. | Intangible assets include brands, technology, know-how; control from third parties is key to determining GDLK. | Two businesses jointly use technology controlled by an affiliated third party; the use of the technology is coordinated by the affiliated third party. |

| Depends on Service Cost | Enterprises receive over 50% service costs from affiliated service providers. | Applicable to IT, accounting, management services… | Company A (Vietnam) receives marketing, accounting, and management services from Company B (foreign), with the cost accounting for 60% of A's total service costs. A and B are affiliated parties. |

The above 3 cases show that determining whether a business has related-party transactions is not only based on the ownership ratio or direct control, but also on dependent factors such as input materials, service costs received from related parties and the use of intangible assets. Correctly and fully understanding these criteria helps businesses declare related-party transactions accurately, meeting the requirements of Decree 132/2020/ND-CP, while minimizing the risk of being assessed, collected or penalized during tax inspections.

Group 4: Other relationships

In addition to ownership, control and economic dependence relationships, Decree 132/2020/ND-CP also expands the scope of identification in the declaration of related-party transactions based on the “substance determines form” factor. This allows tax authorities to assess specific relationships or agreements that do not meet capital ratio thresholds or specific legal conditions, but have a real impact on production and business activities and pricing mechanisms. This approach helps improve the effectiveness of anti-transfer pricing and ensures that declaration obligations are implemented in accordance with the market price principle.

Rules on Transaction Thresholds and Exemptions from Declaration of Related-Party Transactions

Enterprises are exempted from preparing a Profile if they meet one of the following conditions:

Conditions on Transaction Size and Value:

- Total revenue generated during the tax period is less than 50 billion VND;

- Total value of all related transactions arising in the tax period is under 30 billion VND.

Conditions for the Effectiveness of the Advance Pricing Agreement (APA):

- The Enterprise has signed an Advance Pricing Agreement (APA) and continues to comply with this Agreement.

Low Transfer Pricing Risk Conditions (Simple Transfer Pricing):

- Enterprises only have transactions with related parties that are subject to corporate income tax in Vietnam;

- Apply the same corporate income tax rate as the related party (i.e. there is no difference in tax rates);

- Both parties involved are not entitled to corporate income tax incentives during the tax period (except for administrative procedure incentives);

- Total revenue generated during the tax period is less than 200 billion VND;

- Apply the net profit margin before interest and corporate income tax on net revenue, after deducting interest expenses and non-deductible expenses as prescribed for distribution from 5% or more, for production from 10% or more and for processing from 15% or more.

Even if exempted from preparing a Profile, the enterprise must still:

- Fully declare information about GDLK in Form 01 (GDLK Appendix attached to Corporate Income Tax Finalization).

- Compliance with the arm's length principle is required (prices must be within market price range).

- Pay special attention to the interest expense limit.

Important Note:

- Fully declare information about GDLK in Form 01 (GDLK Appendix attached to Corporate Income Tax Finalization).

- Exemption from declaring related-party transactions (exemption from preparing a Price Determination File) Are not This means that the business is exempt from applying the ALP principle. Transactions must still be conducted at market price. If the business does not meet the above exemption conditions, they are required to create and maintain a Price Determination Record.

Regulations on declaring related-party transactions

The obligation to declare related-party transactions is fulfilled through the submission of mandatory forms.

Mandatory form for declaring related-party transactions.

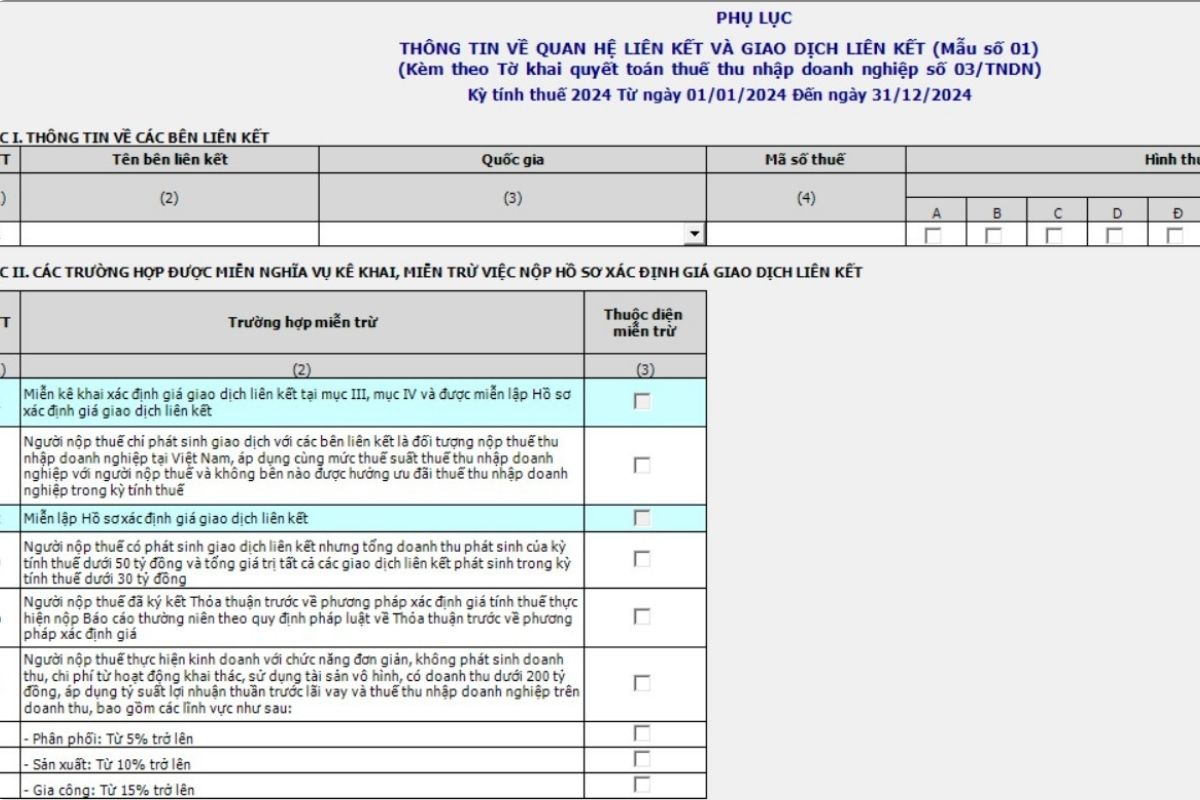

Businesses with related-party transactions must submit the Related-Party Transaction Appendix Form No. 01 (according to the Appendix issued with Decree 132), which includes 3 main parts, attached to the Corporate Income Tax Return:

Form 01 – Appendix I: Information on Affiliated Parties

Enter the business's information, country, and tax identification number. Then, list the related parties, the related-party relationship (select one of the 10 relationships in Article 5 of Decree 132), and the type of related-party transaction (buying and selling, services, finance, asset transfer, etc.).

For example: This is where you declare your director's loan or bank loan if there is a joint guarantee.

Form 01 – Appendix II: Cases Exempt from the obligation to declare related-party transactions and Exempt from submitting price determination documents.

In the section on declaring related-party transactions in Appendix II, if the enterprise falls under the cases exempted from declaring related-party transactions as mentioned above, then mark that case, but it is still mandatory to declare them in Appendix I.

Form 01 – Appendix III: Information for Determining the Price of Related-Party Transactions

If the enterprise is exempted, it is not necessary to declare related-party transactions in Appendix III. However, if it is not exempted under the Decree, it is mandatory to declare related-party transactions in Appendix III.

Appendix III is extremely important, reflecting the true nature and value of related party transactions between related parties. Appendix III, the content that businesses need to pay attention to when declaring related party transactions:

- The recognized value of related-party transactions

- Revalued value based on Independent Transaction price

- Pricing method

Note: The three aforementioned related-party transactions must be fully declared on both sides: the value of sales to the related party and the value of purchases from the related party. This helps the Tax Authority gain a comprehensive view of the value chain and profit allocation within the group.

Deadline for submitting Form 01

Form 01 must be submitted at the same time as submitting the Corporate Income Tax Finalization Declaration, which is the 90th day from the end of the calendar year or fiscal year.

Allocation of Interest Expense

The most important part of the obligation to declare related-party transactions is the management of interest expenses according to Article 16 of Decree 132/2020/ND-CP. This is a popular transfer pricing control mechanism in the world.

- Rule: The total net interest expense (after deducting interest on deposits or loans) deductible when determining corporate income tax must not exceed 30% of the total net profit from business operations plus net interest expense and depreciation expense for the period (EBITDA).

- Excess: The portion of interest expense exceeding the 30% EBITDA threshold will not be deducted when determining taxable income.

Transfer pricing determination dossier

The preparation of a Market Price Determination Profile is the clearest evidence of an enterprise's compliance with the regulations on declaration of related party transactions.

The purpose of the Valuation Report is to document that the company's related-party transactions have been valued at market price (ALP). This is the most important legal evidence to avoid being subjected to valuation by the Tax Authority.

Attention: Businesses must complete the Pricing Documentation before submitting the Corporate Income Tax Return. Delays or incomplete documentation may result in administrative penalties and the imposition of a fixed price.

Local File

The Local File is the most detailed document, focusing on the business transactions in Vietnam. It must include the following analysis:

- General information: History, organizational structure, business strategy of enterprises in Vietnam.

- GDLK analysis: Detailed description of each type of GDLK, including value and contract terms.

- Function, Risk, and Asset Analysis (FAR Analysis): FAR analysis is the heart of the valuation dossier. It analyzes the functions (production, R&D, sales, etc.), risks (market, credit, inventory, etc.), and assets (tangible, intangible, IP) that the enterprise performs and holds in the value chain. The purpose is to determine the role of the enterprise in the group as a basis for choosing the appropriate transfer pricing method.

Benchmarking

Requires businesses to seek out independent (non-affiliated) companies operating in similar industries, markets and business conditions to compare their financial metrics (such as profit margins, profitability ratios).

Regarding selection criteria, it is advisable to use international or regional databases, establishing strict comparison criteria (currency, geographical area, functional similarity).

Master File

The Master File provides a comprehensive overview of the operations of a multinational corporation.

- Applicable: Applicable to corporations with total global consolidated revenue reaching the prescribed threshold (usually 10,000 billion VND).

- Contents: Overview of global organizational structure, supply chain, description of key intangible assets (IP), internal financial policy.

Country by Country Reporting (CbCR)

Detailed information on income distribution, taxes paid, and business activities by country or territory. Especially applicable to multinational corporations with total consolidated revenue reaching the threshold of VND 18,000 billion.

Risks, consequences and plans for business

Even though they have complied with the declaration of related party transactions according to Form 01, enterprises may still face risks if the Pricing Determination Profile is not strong enough.

Tax compliance and audit risks

Common errors in declaring related party transactions:

- Errors in filling out Form 01 (Appendices I, II, III)

- Failure to declare (or under-declare) related party transactions involving loans or advances. For example, borrowing money from the Board of Directors without determining the interest rate at Market Price (ALP).

- Missing Valuation Documents: This is the most serious error, leading to tax assessment.

Legal consequences and tax assessment procedures

If the Tax Authority detects that the transaction is not at market price, the enterprise will be subject to corporate income tax (including late payment interest).

Article 10 of Decree 132/2020/ND-CP states that the Tax Authority has the right to determine the transfer pricing tax and the amount of tax payable in the following cases:

- Enterprises do not declare related party transactions (Form 01) or do not provide Price Determination Documents.

- Documents are provided but lack legal basis to determine price according to ALP.

- Failure to demonstrate that the price/yield is consistent with the market threshold.

Action Plan for Businesses

To ensure absolute compliance with the obligation to declare related-party transactions and determine the price of related-party transactions according to Decree 132/2020/ND-CP, enterprises should implement a 4-step action plan:

Review and classify GDLK

- Review all affiliated relationships (8 cases in Article 5 of Decree 132).

- Classify all transactions that occurred during the year (sales, services, finance, IP).

- Exemption Decision: Determine whether the business is exempt from declaring related-party transactions (exempt from filing). If so, basic records still need to be retained.

Perform FAR analysis

- Conduct a Function, Risk, and Asset Analysis (FAR Analysis) for each transaction type.

- This is the basis for choosing the appropriate valuation method.

Prepare and complete the dossier.

- Conduct Benchmarking to determine market price ranges.

- Apply the chosen method (usually TNMM) to adjust the profit to the market threshold.

- Complete Local File, Master File (if required) before the deadline for submitting Corporate Income Tax Finalization Declaration.

Declaration and payment

- Fill out Form 01 (Appendix I, II, III).

- If there is an increase/decrease in profit due to determining the transfer pricing, make the adjustment immediately on the Corporate Income Tax Finalization Declaration.

- Submit the declaration of related party transactions (Form 01) together with the Corporate Income Tax Declaration.

Conclude

The obligation to declare related-party transactions under Decree 132/2020/ND-CP has set higher compliance standards than ever before, especially for enterprises belonging to multinational corporations or having large borrowing or lending transactions.

To ensure compliance and avoid the risk of tax assessment, the Market Price Determination Document is the most important legal "shield" for businesses.

Businesses should look for highly specialized units as reference. auditing services and in-depth pricing advice, to perform accurate FAR Analysis and Benchmarking, ensuring all related party transactions strictly comply with the arm's length principle.

Contact MAN – Master Accountant Network to receive timely advice and support.

Contact information MAN – Master Accountant Network

- Address: No. 19A, Street 43, Tan Thuan Ward, Ho Chi Minh City

- Mobile/Zalo: 0903 963 163 – 0903 428 622

- Email: man@man.net.vn

Content production by: Mr. Le Hoang Tuyen – Founder & CEO MAN – Master Accountant Network, Vietnamese CPA Auditor with over 30 years of experience in Accounting, Auditing and Financial Consulting.

MAN Editorial Board – Master Accountant Network