The related-party transaction appendix is the first risk "touchpoint" that tax authorities consider when assessing signs of transfer pricing by businesses. In the context of stricter regulations under Decree 132/2020/ND-CP and the OECD's BEPS standards, any errors in declaration can trigger in-depth tax audits. With increasingly stringent tax management against transfer pricing under OECD (Organization for Economic Cooperation and Development) standards, understanding, accurately declaring, and managing risks related to the related-party transaction appendix becomes a vital requirement for all organizations that conduct transactions with related parties.

The importance of compliance with related party transaction regulations.

Transfer pricing is a central issue in international tax administration. Vietnam, through the issuance of Decree 132/2020/ND-CP, has demonstrated alignment with the OECD's Base Erosion and Profit Shifting Action Plan (BEPS Actions). The core objective is to ensure that profits are allocated to where real economic value is created.

The related-party transaction appendix (including forms 01, 02, and 03) is an integral part of the Related-Party Transaction Pricing Documentation and is submitted with the Corporate Income Tax Return Form No. 03/TNDN. This declaration helps the tax authorities gain an overview of the value chain and potential transfer pricing risks of the enterprise.

The purpose of this article is to provide practical guidance based on Decree 132/2020/ND-CP and related documents to help businesses prepare related-party transaction appendices accurately and optimally.

Why is the Related Party Transaction Appendix considered a “High-Risk Document” in Tax Administration?

Many businesses often confuse submitting the Transfer Pricing Appendix with completing the full Transfer Pricing Documentation (Master File and Local File).

- Related Party Transaction Appendix (Forms 01, 02, 03): This is a mandatory annual summary report that must be submitted publicly. It is the first review tool used by the tax authorities. Errors in the Related Party Transaction Appendix will immediately trigger a tax audit.

- Pricing documentation: This is a set of documents proving the independence of the transaction price. It only needs to be prepared and stored at the business and submitted when requested by the Tax Authority.

If a business fails to submit or submits the related-party transaction appendix late, it may face administrative penalties ranging from VND 8 million to VND 25 million as stipulated in Articles 19 and 20 of Decree 125/2020/ND-CP. In addition, it may be subject to tax recovery, tax assessment, and late payment penalties if transfer pricing is found.

Core legal basis and foundational concepts

Based on the established legal framework and fundamental concepts, the next step is to look at the most important regulatory framework currently in place: Decree 132/2020/ND-CP – the document governing all activities related to the declaration and management of related-party transactions.

The core principle for filling out the Related Party Transaction Appendix is the Arm's Length Principle. This principle states that transactions between related parties must be conducted at the same price and under the same conditions as transactions between independent parties under the same conditions.

Accurately identifying the Related Party is the first and most important step when preparing a related-party transaction addendum.

Details of Affiliated Parties as per Decree 132/2020/ND-CP

Based on Clause 2, Article 5 of Decree 132/2020/ND-CP, the related party relationship is defined in detail in the following 11 cases. Accurately identifying these cases is the first and most important step when preparing the Appendix on related party transactions:

- An enterprise directly or indirectly holds at least 25% of the equity of the owner of the other enterprise.

- Both enterprises have at least 25% of owner's equity held directly or indirectly by a third party.

- One business is the largest shareholder in terms of owner's equity and directly or indirectly holds at least 10% of the total owner's equity of the other business.

- A business guarantees or lends money to another business on the condition that the loan accounts for more than 50% of the total value of the borrower's assets, and that the loan accounts for more than 50% of the borrower's total medium and long-term debt (excluding loans from credit institutions).

- One party appoints over 50% the total number of members of the executive body or those authorized to decide on the financial and business policies of the other party.

- Two businesses share more than one board member or have the same individual or organization with the authority to make decisions on financial and business policies.

- Two businesses are managed or controlled in terms of personnel, finance, and business operations by an individual through that individual's ownership of capital or direct involvement in management.

- The two businesses have a family relationship (husband, wife, father, mother, child, brother, sister) between the Director/CEO of one business and the Director/CEO of the other business.

- Two businesses are controlled by one or more individuals through the joint ownership of shares/capital contributions by those individuals, and this controlling percentage exceeds the 50% equity capital.

- The business has transactions with individuals/organizations that are directly or indirectly related to the operation, control, or have a significant influence on the decision-making of the business.

- An affiliated relationship arises when a business transfers capital contributions from 25% or borrows/lends capital contributions from 10% to an individual who manages, controls, or is classified as an affiliated entity according to regulations.

After clearly identifying related parties as stipulated in Decree 132/2020/ND-CP, the next step is to accurately understand the nature of related-party transactions, i.e., transactions arising between entities with related relationships that may affect the tax obligations of the enterprise.

What are related-party transactions?

According to Decree 132/2020/ND-CP of the Government on tax administration, related party transactions are understood as transactions arising in the production and business process between related parties. Related party relationships here are relationships in which one party has the ability to dominate, control or significantly influence the conditions, policies or business results of the other party.

Related transactions may include the following types of transactions:

- Buying and selling goods, providing and using services.

- Borrowing, lending, financial guarantee activities.

- Purchase or transfer of fixed assets.

- Transfer of intellectual property and technology.

- Allocation of costs or profits among related parties.

After understanding what related-party transactions are and how to identify them according to Decree 132, the next step for businesses is to grasp the cases exempt from declaration. This mechanism helps reduce the burden of documentation but only applies when all legal conditions are met.

Regulations on Exemption from Filing

Decree 132/2020/ND-CP provides conditions for exemption from preparing a Price Determination Dossier, but does not exempt the submission of the Related Party Transaction Appendix Form No. 01.

Cases where a price determination report is waived but must still be submitted. Related Party Transaction Appendix Form 01, includes:

- There are related party transactions but the total revenue in the tax period is less than VND 50 billion/year and the total value of all related party transactions arising in the period is less than VND 30 billion/year.

- Signed an advance pricing agreement (APA) according to Circular 201/2013/TT-BTC;

- Businesses operate with a simple function (production based on orders, therefore not subject to inventory risk). Furthermore, they do not incur any operating costs. In addition, they must have annual revenue below VND 200 billion (excluding revenue from the exploitation and use of intangible assets such as royalties), and meet the EBIT requirements of each industry: Distribution industry: 51 units of 3T or more; Manufacturing industry: 101 units of 3T or more; Processing industry: 151 units of 3T or more.

Note: Even if exempt from filing, businesses are still required to prepare and submit the Related Party Transaction Appendix Form 01 as prescribed.

Details of the sections in the Appendix on Required Disclosure of Related Party Transactions

This section provides a detailed analysis and guidance on how to fill out the most important related-party transactions that must be submitted with the Corporate Income Tax Return.

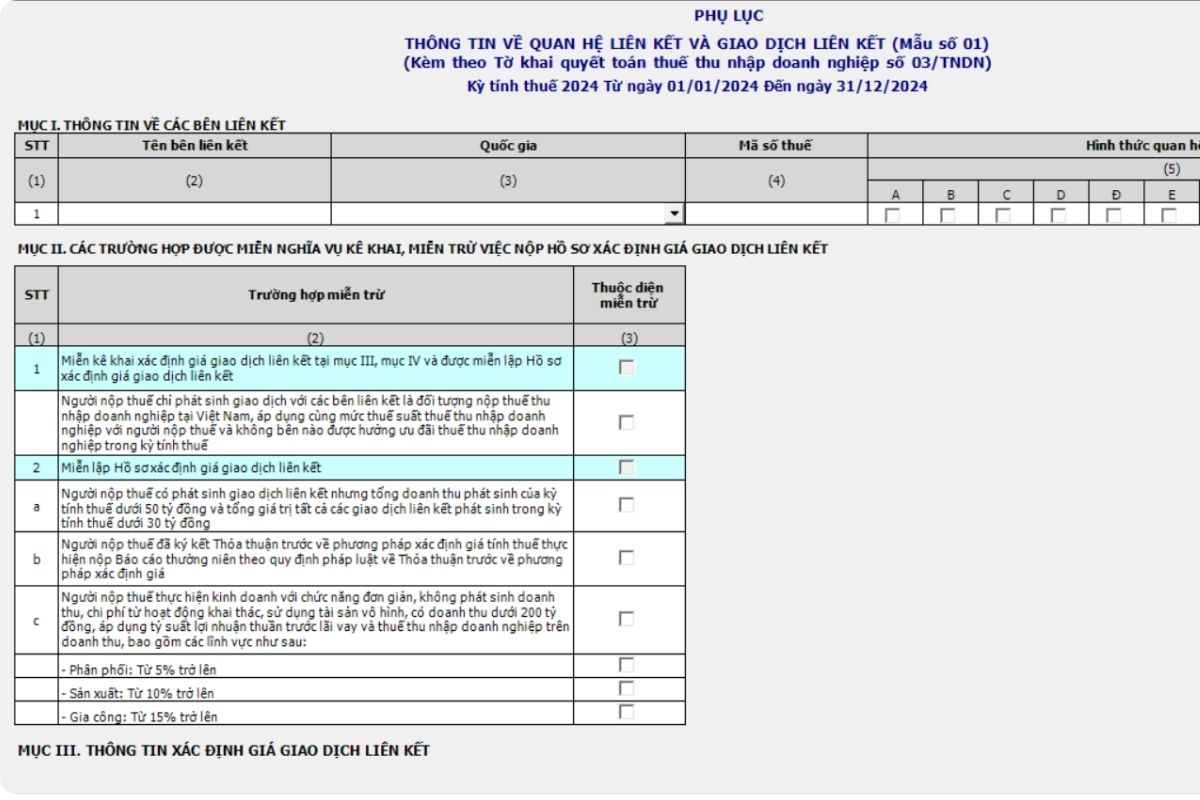

Appendix to Related Party Transactions Form 01/GDLK

The Related Party Transaction Appendix Form 01 provides an overview of the structure of related parties, types of transactions, and transaction values. This serves as the basis for tax authorities to determine the scale and level of transfer pricing risk of the enterprise.

Section I: Information of related parties

In Section I, businesses need to fill in the following information:

- Affiliate Name

- Nation

- Tax code

- Type of affiliated relationship: Businesses need to clearly identify the Affiliated Party according to the specific case in the 11 cases mentioned above (corresponding to A, B, C, D, E, G, H, I, K, L on the system).

Section II: Cases exempt from the obligation to declare and submit price determination documents.

Section II: Businesses must clearly identify whether they are exempt from the obligation to declare or submit Transfer Pricing Documentation. If the business meets one of the exemption conditions under the Decree, select the box corresponding to its exemption condition.

Note: If both businesses are subject to the same corporate income tax rate (20%), neither party will be eligible for corporate income tax incentives.

If the business qualifies for this exemption, it only needs to declare in Sections I and II.

Section III: Information on determining transfer pricing

Section III of Form 01, Appendix on Related-Party Transactions, is where businesses report on how they have applied the independence principle, which pricing methods they have used, and the results of their price analysis.

Choosing a Pricing Method: Businesses must explain their choice of method. Five main accepted methods include:

- CUP (Comparable Uncontrolled Price).

- RPM (Resale Price Method).

- CPM (Cost Plus Method).

- TNMM (Transactional Net Margin Method).

- PSM (Profit Split Method).

For example, if the company is a contract manufacturer, the net profit margin method is typically chosen to compare net profit margin on costs. This choice must be explained in detail in the pricing documentation and summarized in the Related Party Transactions Appendix, Section III.

Section IV: Business Performance Results

- This section details the transaction values that occurred during the period. These values must match the corresponding accounts on the Financial Statements and the Corporate Income Tax Return.

- Fees for buying or selling goods or services: Clearly state the total value of the purchase and sale.

- Interest expense or interest payments: This related-party transaction appendix must record the total amount of interest expense incurred. Disclosing interest expense in this section is the first step in subsequently applying the 30% EBITDA limit.

- Other expenses include royalties, administrative fees, or loans/borrowings. Businesses need to ensure these expenses are fully documented with invoices, receipts, and clear service contracts, adhering to the principle of "actual benefit".

Providing complete and accurate information in the Related Party Transaction Appendix Form 01 is a stepping stone to ensuring transparency and compliance.

Tax compliance and risk management strategy

It's not just about filling it out. Related Party Transaction Appendix Instead of mechanically managing risks, businesses need proactive strategies to optimize tax compliance.

Self-adjusting and resetting prices

Article 13 of Decree 132/2020/ND-CP provides a flexible mechanism allowing enterprises to adjust their transfer pricing to bring their profit margins within an independent range, thereby minimizing the risk of being subject to tax recovery.

- Self-adjustment mechanism for increasing taxable income: If a company's profit margin is lower than the median (P50) or the independent range, the company must adjust its taxable income upwards. This mechanism protects the company from penalties for transfer pricing. This must be reflected in the related-party transaction appendix and the tax return.

- Income Reduction Adjustment: A rare case where a reduction adjustment is permitted is when the tax authorities have already audited and issued a tax assessment decision for the foreign affiliated party, and this reduction adjustment does not reduce taxable income in Vietnam.

Managing interest expense risk

Regulations limiting interest expense are a major risk for corporations with thin financial structures.

- The limit: The total interest expense after deducting interest on deposits and loans incurred during the period of the enterprise that is deductible for corporate income tax purposes must not exceed 30% of the total net profit from business operations during the period (EBITDA).

Management strategy:

- Businesses need to closely monitor their EBITDA on a quarterly basis.

- If interest expense exceeds the 30% EBITDA threshold, the excess amount will not be deductible for corporate income tax purposes, although it may still be subject to deductions. Declare related-party transactions.

- This non-deductible portion of interest expense can be carried forward to the next tax period for up to five consecutive years. This is an important point to note in order to optimize tax benefits.

Conclude

In the context of increasingly stringent transfer pricing regulations by tax authorities, even minor errors in declaring related-party transactions can cost businesses dearly: tax assessments, back taxes for many years, late payment penalties, and even comprehensive audits. Many businesses face risks due to seemingly insignificant errors such as incorrectly identifying related-party relationships, omitting transactions, or inconsistent figures with financial statements.

This is why businesses need to thoroughly and properly review their related party records right from the start. Contact MAN – Master Accountant Network for timely advice and support.

Take proactive steps before risks arise; start reviewing your affiliate transaction history today!

Contact information MAN – Master Accountant Network

- Address: No. 19A, Street 43, Tan Thuan Ward, Ho Chi Minh City

- Mobile/Zalo: 0903 963 163 – 0903 428 622

- Email: man@man.net.vn

Content production by: Mr. Le Hoang Tuyen – Founder and CEO of MAN – Master Accountant Network, CPA Vietnam with over 30 years of experience in accounting, auditing, and financial consulting.

Editorial Board of MAN – Master Accountant Network