Identifying related party transactions (FDIs) is the first and foremost important step for businesses to comply with tax regulations and avoid the risk of being charged, having prices fixed or adjusted during audits and inspections. In the context of Decree 132/2020/ND-CP and Decree 20/2025/ND-CP With the increasingly tightened transfer pricing management, understanding and accurately identifying related-party transactions is not only a legal requirement, but also a core financial management capability of the enterprise. This article provides in-depth guidance, full analysis of the legal basis, practical examples and a 3-step standard process to help enterprises identify related-party transactions comprehensively and clearly to proactively prevent tax risks.

What is affiliate trading?

Associated transactions are transactions arising in production and business activities between parties that have an associated relationship with each other, for example, between a parent company and a subsidiary.These transactions may be the sale of goods, the provision of services, the lending, the leasing, the transfer of assets, or the sharing of common expenses.

These transactions are not market-based in nature (i.e., the Arm's Length Principle). Due to mutual control or influence, prices, yields, or terms of transactions may be manipulated to shift profits from high-tax to low-tax locations (also known as Transfer pricing).

What is the purpose of identifying related party transactions?

The management and identification of related-party transactions aims to combat base erosion and profit shifting (BEPS), ensuring that businesses do not take advantage of related-party relationships to illegally reduce their corporate income tax (CIT) obligations in Vietnam.

Legal basis

Any determination of related party transactions in Vietnam must strictly comply with the provisions at:

- Decree 132/2020/ND-CP issued on November 5, 2020, replacing Decree 20/2017/ND-CP). This is the most detailed legal document regulating the management of related-party transaction tax.

- Decree No. 20/2025/ND-CP issued on February 10, 2025 and effective from March 27, 2025. This document amends and supplements a number of important points in Decree 132/2020/ND-CP, especially expanding the scope of determining related-party transactions by amending the cases considered as Related Parties.

Understanding the above Decrees is a legal requirement. However, to translate complex legal provisions into practical risk management and compliance actions, businesses need a standardized working process.

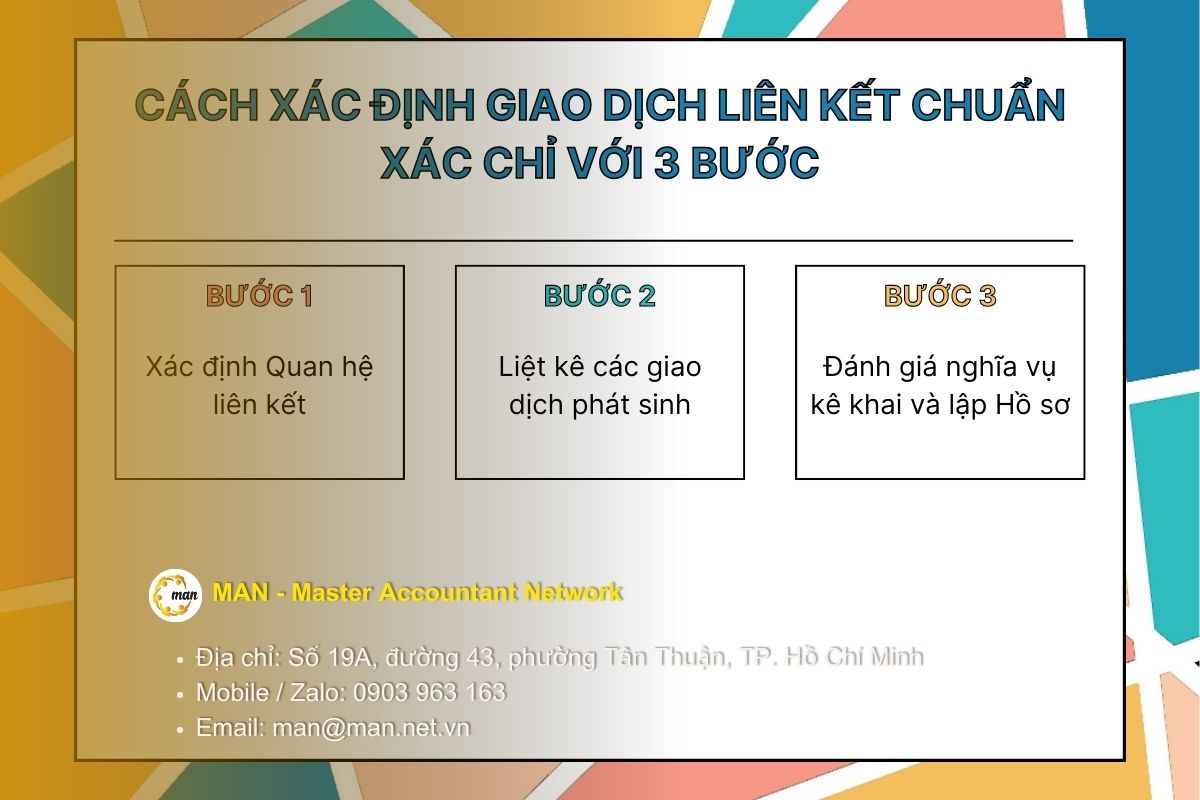

How to Identify Affiliate Transactions Accurately in Just 3 Steps

For a transaction to be identified as an affiliated transaction, a business needs to follow the following 3-step process:

Step 1: Identify the Affiliate Relationship

This is the fundamental step, deciding which entity is considered an Affiliated Party according to the regulations. Affiliated relationships are clearly defined in Clause 2, Article 5, Decree 132/2020/ND-CP and supplemented in Decree 20/2025/ND-CP.

Step 2: List the transactions that have occurred

After identifying the Related Parties, the enterprise needs to list the transactions of purchase, sale, borrowing, lending, provision of services, transfer of intangible assets, etc., arising between these parties during the tax period.

Note: Having an affiliated relationship but no related party transactions? Only when both elements (“Affiliate Relationship” and “Incurred Transactions”) exist, is it a declared Related Party Transaction. If two enterprises have an affiliated relationship (for example, the same parent company owns 25% capital) but during the fiscal year there are no sales, purchases or loans between them, they are still “Affiliate Parties” but there is no related party transaction to declare.

Step 3: Assessment of Declaration Obligations and Filing

Once the related party transaction has been accurately identified, the enterprise must fulfill the declaration obligation according to the Appendix on related party transactions and consider the obligation to prepare the Transfer Pricing Determination File (Transfer Pricing File).

See details: Related transactions Decree 132

In-depth analysis of forms of Affiliate Relationships

To properly identify related party transactions, it is necessary to clearly understand the forms of related party relationships detailed in Article 5 of Decree 132/2020/ND-CP. This is the most complicated part, where tax experts need high precision.

Group of Relationships based on Capital and Ownership (Capital Control)

For businesses to clearly understand and correctly apply the determination of related-party transactions, the most important step is to analyze each form of related-party relationship as prescribed in Article 5 of Decree 132/2020/ND-CP and the amendments in 2025. The following cases represent the group of related-party relationships based on capital, ownership and control, which is the basis for deciding whether two businesses are considered Related Parties or not. The table below summarizes each regulation point with in-depth analysis and illustrative examples to help businesses identify accurately and avoid omissions.

| Form | Analysis and illustrative examples |

| Direct or indirect control of 25% capital contributions. | One enterprise directly or indirectly holds at least 25% of the equity of the other enterprise. This is the most basic criterion. Indirectly means through one or more intermediary companies. |

| The same third party holds 25% of equity. | Both enterprises have at least 25% of owner's equity held directly or indirectly by a Third Party. For example: Company M owns 30% of A's capital and 40% of B's capital. Then, A and B are Affiliates of each other. |

| The largest shareholder holds at least 10% shares. | One enterprise controls the appointment, election, or dismissal of most or all of the members of the Board of Directors or the Supervisory Board of the other enterprise. Power over senior personnel is considered control. |

| Management by Contract Agreement. | Two businesses are jointly managed or controlled for financial and business decisions by one individual or organization through an agreement or contract. |

Thus, the above cases are an important foundation to help businesses correctly identify related relationships according to current regulations. Understanding and fully comparing each point will help businesses accurately determine the scope of Related Parties, thereby properly performing the obligation to declare and control tax risks throughout the entire process of identifying related-party transactions. Next, we will move to the group of related-party relationships based on actual operation, management and control, the group with the most expansion points and the most likely to generate risks.

The Affiliate Relationship Group is based on Operations, Management and Finance (Real Control)

To clarify the group of related relationships based on operations, management and finance, enterprises need to grasp the cases showing actual control between the parties, even when not directly derived from the capital ownership ratio. This is a group of relationships with a strong expansion in Decree 20/2025/ND-CP and is a common reason why enterprises accidentally fall into the category of related-party transactions without realizing it. The table below summarizes each regulation point, in-depth analysis and updates the new points in 2025 to help enterprises identify accurately and completely:

| Form | Analysis |

| Same Individual Operating or Controlling. | There is at least one individual participating in the operation or control of this enterprise, and is also a member of the Board of Directors, Director (or equivalent title) of the other enterprise. |

| Borrowing or lending to an Executive or Controlling Individual. | The enterprise borrows or lends money to an individual who operates or controls the enterprise and this loan or lending accounts for at least 10% of the owner's equity at the time of the transaction. This is a very common case when an enterprise borrows money from the Director or Chairman of the Board of Directors. |

| Individual 10% Capital and Control. | An individual holds at least 10% of owner's equity in an enterprise and this individual is also a member of the Board of Directors or has control of the other enterprise. |

| Major Financial Guarantee or Loan. | An enterprise guarantees or lends capital to another enterprise, if that loan accounts for minimum 25% capital contribution of the owner of the borrowed and occupied enterprise on 50% total value of medium and long-term debts of the borrowing enterprise. This regulation ensures control of dominant financial relations. |

| Reality Control | New point 2025 (Decree 20/2025/ND-CP): This provision is amended to expand the scope, including independent accounting branches if this branch is subject to the actual management, control, and decision-making on the production and business activities of the other enterprise. |

| Relationship between Credit Institution and related parties. | New point 2025 (Decree 20/2025/ND-CP): Supplementing the regulation that a Credit Institution is an affiliated party with a Subsidiary, Controlling Company, or Affiliated Company of a Credit Institution according to the Law on Credit Institutions. Note: Regular corporate loans to banks are still not affiliated transactions. |

Thus, the above cases show that the scope of the affiliated relationship does not stop at the capital ownership ratio but also extends to the operational, control and actual financial influence. This is the reason why enterprises must carefully review the governance structure, loans, guarantees and the role of each key individual to avoid missing situations where affiliated transactions arise. Fully identifying the forms is an important foundation before moving on to the next step of determining which transactions between these parties must be declared according to regulations.

How to Identify Related Transactions: Forms and Obligations

Once the Affiliate has been identified, businesses need to understand the common forms of related party transactions and the associated reporting obligations.

Popular forms of affiliate trading

Affiliated transactions include all transactions arising between Affiliated Parties, usually focusing on 5 main groups:

- Purchase or Sale of Goods Transactions: Transactions of raw materials, finished products, goods and services within the group.

- Service Provision Transactions: Management services, legal consulting, accounting, marketing, R&D…

- Financial Transactions: Borrowing, lending, guaranteeing, investing capital.

- Asset Lease Transactions: Land, factory, machinery, equipment lease.

- Intangible Asset Transactions: Transfer, licensing of trademarks, patents, technological know-how (Royalty Fee).

Correctly classifying transactions according to the common forms above is the first and important step. Once the Related Party Transactions are identified, the enterprise is required to move on to implementing the Compliance and Disclosure obligations in accordance with the law to avoid tax risks.

Declaration obligations and how to declare the Annex to related party transactions

Taxpayers with related party transactions must declare according to the Declaration form and Appendix issued with the Decree.

- Transfer pricing declaration: Declare information on related party transactions in Appendix I. Updated 2025, Enterprises need to declare the newly issued Appendix I attached to Decree 20/2025/ND-CP, submit it together with the Corporate Income Tax Finalization Declaration (usually 90 days from the end of the fiscal year).

See details: Declare related party transactions on the accounting system according to Decree 132/2020/ND-CP

The dossier for determining the price of related-party transactions aims to provide documents proving that related-party transactions are carried out according to the principle of independent transactions, avoiding price determination by tax authorities. The structure of the dossier will include 3 levels:

- Local File: Details of the company's transactions, functional analysis, risks and assets in Vietnam.

- Master File: Overview of the group's global business operations.

- Country by Country Report (CBCR): The report provides information on the distribution of income, taxes and business activities globally (applicable to Groups with total consolidated revenue of VND 18,000 billion or more).

Cases exempted from preparing price determination dossiers

Enterprises are exempted from preparing a Price Determination Document if they meet one of the following conditions:

Conditions on Transaction Size and Value:

- Total revenue generated during the tax period is less than 50 billion VND;

- Total value of all related transactions arising in the tax period is under 30 billion VND.

Conditions for the Effectiveness of the Advance Pricing Agreement (APA):

- The Enterprise has signed an Advance Pricing Agreement (APA) and continues to comply with this Agreement.

Low Transfer Pricing Risk Conditions (Simple Transfer Pricing):

- Enterprises only have transactions with related parties that are subject to corporate income tax in Vietnam;

- Apply the same corporate income tax rate as the related party (i.e. there is no difference in tax rates);

- Both parties involved are not entitled to corporate income tax incentives during the tax period (except for administrative procedure incentives);

- Total revenue generated during the tax period is less than 200 billion VND;

- Apply the net profit margin before interest and corporate income tax on net revenue, after deducting interest expenses and non-deductible expenses as prescribed for distribution from 5% or more, for production from 10% or more and for processing from 15% or more.

Even if exempted from preparing a Profile, the enterprise must still:

- Fully declare information about GDLK in Form 01 (GDLK Appendix attached to Corporate Income Tax Finalization).

- Compliance with the arm's length principle is required (prices must be within market price range).

- Pay special attention to the interest expense limit.

However, exemption from filing does not mean exemption from compliance with the arm's length principle. When this obligation is not met, the tax authority will adjust the price of the Related Party Transaction.

Tax liability law: Adjusting related transaction prices

When tax authorities inspect and detect that the transaction price does not comply with the arm's length principle, they have the right to make adjustments to the transaction price.

Arm's Length Principle

This is the guideline for determining the reasonableness of related party transactions. According to this principle, the transaction price between the Affiliated Parties must be equivalent to the transaction price between independent parties (not related parties) under the same conditions.

Methods of determining transfer pricing

Decree 132/2020/ND-CP stipulates 05 basic methods to determine market price:

- Comparable Uncontrolled Price (CUP) method: Directly compare the price of goods/services in related transactions with the price of similar independent transactions.

- Resale Price Method (RPM): Suitable for distribution businesses.

- Cost Plus Method (CPM): Suitable for manufacturing and processing enterprises.

- Transactional Net Margin Method (TNMM): Compares the net profit margin of a business with the net profit margin of independent businesses. This is the most common method.

- Profit Split Method (PSM): Allocate profits generated from joint transactions to related parties based on actual contributions.

Businesses need to choose the most appropriate method to prove that their trading prices are reasonable.

Conclusions and practical recommendations

Understanding how to identify related party transactions under Decree 132/2020/ND-CP (and its 2025 amendments) is a must, not only for compliance but also to optimize tax planning and risk management.

Enterprises, especially those with foreign investment or internal loan transactions, need to proactively review their ownership structure and arising transactions to:

- Proactive identification: Ensure that no relationships or transactions that fall under the GDLK category are missed.

- Timely declaration: Prepare and submit the GDLK Declaration (Appendix I) according to the latest form.

- Transfer Pricing Documentation: Prepare a Pricing Documentation to demonstrate the arm's length principle, especially if tax risk is high or there are near-threshold interest costs 30% EBITDA.

Strict compliance with regulations on related party transactions is the most accurate way to identify related party transactions, helping businesses avoid large arrears and fines from tax authorities, while enhancing reputation and transparency in business operations.

If performing the steps of determining and preparing the GDLK valuation dossier yourself is too complicated or your business is facing an upcoming tax inspection, please contact the MAN - Master Accountant Network team immediately for detailed advice, to build a standard GDLK valuation dossier and ensure the highest legal safety for your business.

Contact information MAN – Master Accountant Network

- Address: No. 19A, Street 43, Tan Thuan Ward, Ho Chi Minh City

- Mobile/Zalo: 0903 963 163 – 0903 428 622

- E-mail: man@man.net.vn

Editor MAN – Master Accountant Network