How to calculate interest expense According to Decree 132, it is always a topic that makes many accountants and financial experts have a headache, especially in the context of tax authorities increasingly tightening the management of related-party transactions and controlling loan interest expenses. If businesses are looking for an accurate, highly practical and legally compliant guide, the content below is built according to standards that will help you understand correctly, do it correctly and minimize risks. The article fully summarizes the legal foundation, the formula for calculating EBITDA according to the specific provisions of Decree 132/2020/ND-CP and how to handle the controlled loan interest, helping businesses avoid mistakes that can lead to billions of dong in arrears. Let's go into the detailed analysis, easy to understand and can be applied immediately to your business.

The importance of mastering Decree 132

Determining the correct deductible interest expense when calculating corporate income tax (CIT) is not only a matter of compliance with the law but also a key measure to manage tax risks and optimize reasonable costs. If you miscalculate just one small parameter in the formula, your business may face the risk of being collected by the tax authority, fined for late payment or even having its tax assessed.

Legal basis of deductible interest expenses

Before delving into how to calculate interest expenses under Decree 132, businesses need to clearly understand the context and core principles of this regulation. Decree 132/2020/ND-CP (effective from December 20, 2020, applicable to corporate income tax calculation period from 2020) was issued to replace Decree 20/2017/ND-CP, the main goal is to manage taxes for businesses with related-party transactions, also known as anti-transfer pricing (Anti-Base Erosion and Profit Shifting – BEPS).

Identify businesses with related transactions

Controlling interest expenses under Decree 20/2017/ND-CP (the predecessor of Decree 132) only applies to related-party transactions. However, Decree 132 has expanded the scope of regulation, but first, enterprises must determine whether their enterprise is a subject of related-party transactions or not.

According to Article 5 of Decree 132/2020/ND-CP, related party transactions are transactions between related parties. There are 9 criteria for determining related parties (related parties) that businesses need to pay special attention to:

| Criteria group | Detailed description of the relationship definition |

| Capital criteria | Direct or indirect control: One party participates directly or indirectly in the management, control, capital contribution or investment of the other party. |

| Same third party control: Two or more parties are directly or indirectly controlled or directed by a third party. | |

| Third-party capital: At least 20% of the equity of each enterprise is held directly or indirectly by the same third party. | |

| Operational and personnel criteria | Joint Board of Directors: Two or more 50% enterprises have a number of board members or individuals with the right to decide financial and business policies appointed by the same third party. |

| Personnel connection, family relationship: There is a family relationship (wife, husband, father, mother, children, siblings) or there is a husband-wife relationship between the Board of Directors of both sides. | |

| Financial and Business Criteria | Borrowing or Guaranteeing: One party guarantees or lends to the other party with a loan accounting for 25% or more of the contributed capital and accounting for more than 50% of the total medium and long-term debt of the borrower. |

| Dominant supply source: One party supplying raw materials/supplies/services accounts for more than 50% of the total value of raw materials, supplies and services of the same type of the other party. | |

| Control of technology: One party controls the technology, production or exclusive products, services, or purchases or sales that account for more than 50% of each party's total revenue or expenses. | |

| Business contracts account for a large proportion: Transactions arising between two parties account for 50% of the total transaction value of each party in the period. |

Determining related party transactions is the first and most important step to know whether you need to calculate interest expenses according to Decree 132 or not. This is also the step to answer the question of how to calculate related party transactions according to Decree 132.

The principle of "thin capital"

Decree 132 limits the deductibility of interest expenses to address the problem of “thin capitalization”. This phenomenon occurs when multinational corporations deliberately increase borrowings (from related parties) and reduce equity in high-tax countries, in order to transfer profits out of that country in the form of interest expenses, thereby reducing profits subject to corporate income tax.

This principle sets a specific limit, based on a percentage of profit, to determine the deductible interest expense under Decree 132.

Scope of application of the Control Regulations

This is the key and often confusing change:

- Limitation: The 30% control level applies to the total net interest expense incurred during the period by the enterprise, including loan transactions with related parties and loan transactions with independent parties (except for exclusions).

- Purpose: To ensure fairness and combat transfer pricing more effectively. Therefore, if a business has related-party transactions, the entire interest expense of the business will be limited.

Although the regulation on controlling interest expenses is widely applied to enterprises with related-party transactions, the law still recognizes a number of exceptions to ensure fairness and reflect the true nature of financial activities. Therefore, enterprises need to clearly understand the cases that are excluded from the control regulation according to Point d, Clause 3, Article 16 to accurately assess their obligations.

Cases excluded from the Control Regulations

To avoid affecting normal production and business activities, Decree 132 stipulates that in some cases, interest expenses will not be controlled by the 30% EBITDA threshold. This helps reduce the burden of calculation and compliance.

Uncontrolled interest expenses 30% include:

- Loans from Commercial Banks or Credit Institutions: Interest expenses arising from loans from these organizations in Vietnam. This is the most important relaxation compared to previous regulations, aiming to encourage businesses to borrow capital domestically.

- ODA loans, Government capital: Loans to implement the Government's national target programs (ODA capital, preferential loans of the Government).

- Loans for implementing key programs and projects: Loans to implement programs and projects to invest in developing infrastructure, social housing, and commercial housing for resettlement.

If the enterprise only has loans in this excluded group (and no other controlled loans), the calculation of interest expenses under Decree 132 will become much simpler, so the deductible interest expenses will follow the general provisions of the Law on Corporate Income Tax.

The golden formula to limit interest expenses (30% EBITDA)

This is the core part, where the formula for calculating deductible interest expenses is deciphered and detailed instructions on how to calculate interest expenses according to Decree 132 most accurately.

According to Clause 3, Article 16 of Decree 132/2020/ND-CP, the total net interest expense after deducting deposit interest and loan interest arising during the period of the taxpayer is deductible when determining taxable income of CIT not exceeding 30% of total net profit from business activities in the period plus net interest expense plus depreciation expense in the period.

Meaning of the formula

Deductible interest expense ≤ Net interest expense (actual) ≤ 30% x (Net profit + Net interest expense + Depreciation expense) |

This formula shows the ceiling of interest expenses deductible when calculating corporate income tax, specifically:

- Enterprises can only deduct up to the actual net interest expense incurred, meaning they cannot deduct more than the actual interest paid.

- Most importantly, the amount of net interest expense included in deductible expenses must not exceed 30% EBITDA.

Interest expense is only deductible if it is within the 30% EBITDA limit. Exceeding this limit will be excluded when calculating corporate income tax.

This formula aims to prevent profit shifting through borrowing and lending transactions between related parties. At the same time, it ensures financial transparency, limits businesses from padding borrowing costs to reduce taxes and accurately reflects the profitability of businesses.

See also: Formula for calculating interest on related-party transactions

Important parameters in calculating interest costs according to Decree 132

To understand how to calculate interest expenses according to Decree 132, businesses must accurately determine the following three parameters:

Net interest expense

Net interest expense is the actual interest expense that is controlled.

Net interest expense = Total interest expense incurred during the period – Total interest |

In there:

- Interest Expense: Is the total interest expense recorded in the period (except for capitalized interest expense).

- Deposit interest and loan interest: Income from deposit interest (including term and non-term deposits) and interest from business lending, arising during the period.

If Net Interest Expense is less than zero, meaning that the business has interest income greater than interest expense, the 30% control limit will not apply (the Decree stipulates the limit for expenses, not income). However, businesses still need to calculate EBITDA to ensure compliance.

How to calculate EBITDA according to Decree 132

This is the most complex parameter and is different from the traditional way of calculating EBITDA in financial accounting.

EBITDA = Operating Profit + Net Interest Expense + Depreciation Expense |

To correctly determine the 30% EBITDA limit as prescribed by Decree 132, businesses need to clearly understand each component of this indicator and how to get accurate data on the financial report. The table below summarizes the indicators, data sources and the meaning of each component, helping businesses avoid confusion and apply the formula accurately.

| Ingredient | According to the Business Results Report | Explain |

| Net operating profit | Code 21 (Pre-tax accounting profit) Code 22 (Current corporate income tax expense) | Usually understood as Profit before tax (Code 21), but must be adjusted for other non-operating income or expenses. In fact, it should be taken as Profit from operating activities (Code 20) and adjusted for additional factors. |

| Net interest expense | Calculated by the formula Net Interest Expense | Interest expense after offsetting interest income. |

| Depreciation expense | Is the sum of fixed asset depreciation costs and long-term asset allocation costs. | Figures on accounting books. |

Important Note on Net Operating Profit: This parameter is determined by accounting profit before corporate income tax (Code 21 on the Business Performance Report), then excluding income or expenses not related to business activities (for example, profit or loss from selling fixed assets, profit or loss from liquidation of assets). The purpose is to calculate EBITDA only from the core business production activities of the enterprise.

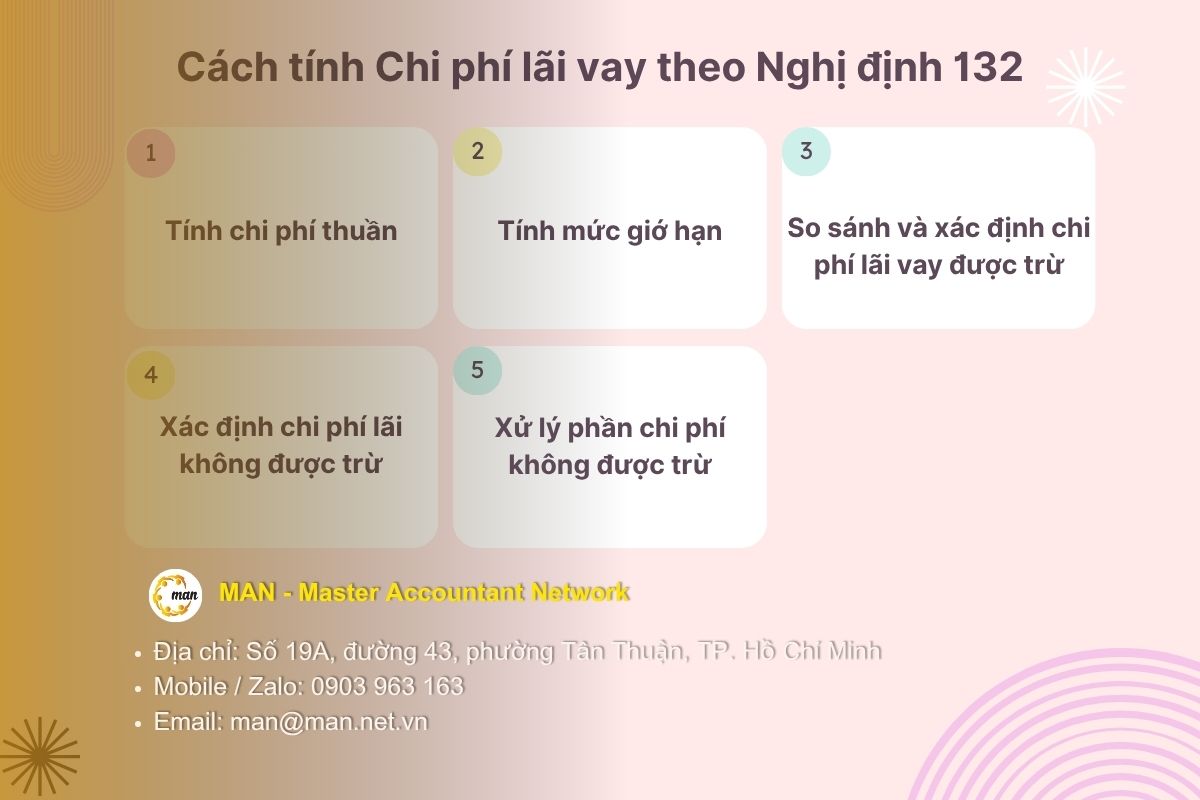

Procedure for determining deductible interest expenses

Apply the method of calculating interest costs according to Decree 132 in the following 5 steps:

Step 1: Calculate net cost

Use the net cost formula explained above.

Step 2: Calculate the limit

The maximum limit of net interest expense deductible when calculating corporate income tax will be determined according to the formula 30% EBITDA (Decree 132) with the following steps:

- Calculate EBITDA according to Decree 132 (apply the above formula)

Determine the maximum limit using the following formula:

Maximum limit = EBITDA x 30% |

Note: If EBITDA is negative or zero, the Maximum Limit is 0That is, the business is not allowed to deduct any net interest expenses.

Step 3: Compare and determine deductible interest expenses

Deductible interest expense when calculating corporate income tax is the smaller of:

- The business's net (actual) interest expense (calculated in Step 1).

- Maximum limit (calculated in Step 2).

Once the maximum allowable interest expense figure is determined, the next step is to calculate the excess interest expense (if any) to determine exactly how much of the non-deductible Interest Expense will be excluded from the allowable expense.

Step 4: Determine non-deductible interest expenses

Determine non-deductible interest expense using the following formula:

Non-deductible interest expense = Net (actual) interest expense – Deductible interest expense (calculated in Step 3). |

This non-deductible interest expense (exceeding the 30% EBITDA threshold) will not be eliminated entirely but will be allowed to be carried forward to be deducted from the taxable income of the following tax periods.

Step 5: Deal with non-deductible expenses

Carry forward the non-deductible interest expense to the next corporate income tax period.

Detailed illustration on how to calculate interest expenses according to Decree 132

To clarify how to calculate deductible interest expense in related party transactions and other loans, consider the following scenario:

Enterprise Z (with related party transactions) has 2025 figures such as interest expense of VND 200 billion, interest income of VND 50 billion, net profit from business operations of VND 800 billion and depreciation expense of VND 100 billion.

| Operation | Result |

| Net interest expense | 150 billion VND |

| Calculate EBITDA | 1,050 billion VND |

| Maximum limit | 315 billion VND |

| Deductible expenses | 150 billion VND |

In this case, the actual Net Interest Expense is 150 billion, which is less than the Limit of 315 billion. Enterprise Z is allowed to deduct the entire 150 billion Net Interest Expense when calculating CIT.

Case 2: Interest expense exceeds threshold

- Suppose the actual Net Interest Expense is 350 billion VND.

- The maximum limit (Step 2) is still 315 billion VND.

- Deductible Interest Expense (Min): 315 billion VND.

- Non-deductible Interest Expense (Over threshold) is 35 billion, this part will be handled by transferring interest expense according to Decree 132 to the next periods.

In Case 2, enterprise Z incurred non-deductible interest expense of VND 35 billion due to exceeding the threshold. So, how will the enterprise handle this excess expense to optimize tax obligations? The answer lies in the important regulation on transferring interest expense to the next tax periods.

Handling of non-deductible interest expenses

One of the most humane and flexible points of Decree 132 is that it allows businesses to reserve and transfer non-deductible interest expenses to the next tax period. This helps to ease tax pressure in the first years of business or difficult years.

Interest expense transfer rules

According to the provisions of Decree 132/2020/ND-CP:

- The portion of interest expense that is not deductible due to exceeding the 30% EBITDA limit will be carried forward to the next CIT period.

- Transfer period: No more than 05 years from the year following the year in which non-deductible interest expenses arise.

However, this carryforward rule is not indefinite and the management of interest expense carryforward also has its own strict rules. Enterprises need to pay special attention to the limitations of interest expense carryforward to optimize the use of these losses and effectively manage tax risks.

Limitations of forwarding

Despite its flexibility, the regulations on interest expense pass-through still have certain limitations that businesses need to be aware of, including:

- If the enterprise cannot use up the non-deductible interest expense within 05 years (from the year following the year of occurrence), the remaining amount will not be deducted from the taxable income of the following periods.

- Tracking and managing these transfers is extremely important for the accounting department.

Conclude

Understanding how to calculate interest expenses according to Decree 132 not only helps businesses comply with the law, but also proactively control tax risks and optimize financial efficiency. When data is determined correctly from the beginning, businesses will avoid adverse adjustments during tax inspections, while building a more transparent and sustainable reporting platform. If your business needs to review related-party transactions, re-check calculation formulas, or build standard records, our team of experts MAN – Master Accountant Network Always ready to accompany and support you completely, quickly and accurately.

Contact information MAN – Master Accountant Network

- Address: No. 19A, Street 43, Tan Thuan Ward, Ho Chi Minh City

- Mobile/Zalo: 0903 963 163 – 0903 428 622

- E-mail: man@man.net.vn

Editor MAN – Master Accountant Network