The risks associated with national profile creation are becoming a "hot topic" in tax audits in 2025, as the Tax Authority will not only be checking the... have records which focuses on evaluation quality and logic of contentMany businesses, even those that comply with deadlines, still face heavy tax assessments, back taxes, and penalties due to errors in functional analysis, pricing method selection, or comparative data. This article systematically summarizes common risks, legal impacts, and a practical prevention checklist to help businesses proactively manage their National File according to OECD standards and the latest regulations in 2025.

What is a national profile?

Local File This is a mandatory document in tax administration for businesses with related-party transactions, used to prove that the transfer pricing is determined according to the arm's-length principle (market price), and is not intended for profit shifting or tax evasion.

A national dossier is a detailed explanatory document about:

- Related-party transactions arising in Vietnam;

- How businesses determine prices, costs, and profits;

- The degree of conformity with market practices compared to independent parties.

This is the most important layer of documentation in the transfer pricing system, directly linked to the corporate income tax payable in Vietnam.

Required components and deadlines for creating Local Files.

All businesses with related-party transactions (except for those exempted under Article 19 of Decree 132/2020/ND-CP) must prepare a National File. The biggest procedural risk in preparing the National File is the deadline: the file must be prepared before the deadline for submitting the Corporate Income Tax Return and must be stored at the business for provision upon request during an audit.

Reference: Instructions for declaring global tax returns on HTKK.

A summary of 5 "fatal" risks when creating a National Profile.

Early identification of common errors will help businesses be more proactive in the 2025 tax settlement period.

Consistency Risk

This is the most common error that causes the Tax Authority to raise suspicions right from the document review stage.

- Data discrepancy: The revenue and expense figures for related-party transactions in Appendix I (Tax Return) do not match the figures presented in the National File.

- Policy versus practice: Businesses issue one internal pricing policy, but implement a different one in their accounting due to a lack of coordination between the tax department and the operations department.

However, even when businesses have ensured consistency in data and policies across the entire national tax return, the risks don't end there. In fact, choosing a pricing method that doesn't match the nature of the transaction is the main reason why many tax returns are rejected by the Tax Authority and subject to tax assessments, opening up another serious risk group besides the risk in choosing the pricing method.

Methodology Risk

Choosing a pricing method that is inappropriate for the nature of the transaction is the quickest way to be subject to tax assessment.

- Misuse of the net profit margin method: Many businesses default to the net profit margin comparison method (TNMM) because the data is easy to find, while actual transactions are more suited to the independent price comparison method (CUP).

- Lack of explanation: The file does not clearly state why other methods were rejected, leaving the Tax Authority with the right to question the objectivity of the current method selection.

However, even after a business has chosen a suitable pricing method, the risks don't stop at the method itself. In fact, the persuasiveness of a national profile depends heavily on the quality of the comparative dataset used to verify the results, because a correct method based on flawed data can still lead to the rejection of the profile. This is precisely the benchmarking risk that businesses often underestimate.

Benchmarking Risk

Comparative data is the "heart" of the National Profile. However, this is also where the most risks lie when creating the National Profile:

- Dissimilarity: Choosing comparable companies that have excessively large asset sizes or operate in markets with completely different economic characteristics.

- Outdated data: Using data from years too far in the past (e.g., 2021) to justify a 2024-2025 transaction without adjusting for post-pandemic market fluctuations.

- Internal Comparables: Ignoring transactions that the business itself conducts with other independent partners, which are the most compelling evidence before the Tax Authority.

Even if the chosen comparative dataset is technically sound and comprehensive, the risks don't stop there. If the functional, asset, and business risk (FAR) analysis doesn't accurately reflect the actual nature of the business's operations, the entire benchmarking result could be rejected by the Tax Authority. This is why the functional and business risk analysis (FAR Analysis) is a crucial step in determining the persuasiveness of the National Profile.

Functional Risk Analysis and Business Risk Analysis (FAR Analysis)

FAR (Functions, Assets, Risks) analysis determines the level of profit that a business "deserves".

- Misrepresentation: Businesses may portray themselves as "outsourcing units" (low profit, low risk) but in reality, they independently decide on production plans, own local brands, or bear significant inventory risks.

- Lack of intangible assets: Failure to present intangible assets (such as technical know-how, customer lists) that contribute to the transaction value, resulting in an undervaluation.

Even if a business has developed a sound and accurate functional, asset, and risk analysis (FAR) that reflects its actual operations, this entire argument may still be rejected by the Tax Authority if it is not supported by a complete, consistent, and legally valid system of supporting documents and records. This is also the reason why many businesses face risks regarding supporting documents and records during related-party transaction audits.

Risks related to documentation and supporting materials.

A national dossier, no matter how well-written, will be rejected if it lacks original supporting documents.

- Loose contracts: Related party contracts lacking clauses on responsibilities and rights, or not being updated with annual appendices.

- Document translation: By regulation, foreign-language documents must be translated into Vietnamese. Risks arise when the translation is inaccurate in terms of specialized terminology or lacks legal validity.

In reality, even with well-structured functional analysis or pricing methods, national dossiers can still be rejected by the Tax Authority simply due to a lack of original documents or insufficient supporting documentation. When this "last line of defense" fails, businesses face serious consequences in terms of taxation, finance, and increased audit risk in subsequent years.

Serious consequences if the National Records are abandoned.

The Tax Authority's rejection of a national record is not merely an administrative error; it triggers a chain of negative financial and legal consequences. When a record is deemed "invalid" or "non-compliant," the business will face:

Direct Tax Assessment

The Tax Authority has the right to reject self-declaration results and determine tax assessments in accordance with the Law on Tax Administration.

- Loss of autonomy: Businesses are no longer protected by their own comparative analyses. The Tax Authority will use internal databases (often with higher profit margins than the free market) to impose target profit levels.

- Applying the industry average profit margin: Typically, instead of allowing a business to fall at the lowest point of the standard margin, the Tax Authority will set it at the median or even a higher percentile if the filing risk is high.

Tax arrears and heavy penalties

The immediate financial consequence is a soaring tax burden:

- Corporate income tax arrears: The additional tax payable is based on the portion of profit that was assessed additionally.

- Late payment penalty: Calculated at a rate of 0.031 TP3T/day on the amount of tax overdue. For audit periods lasting 3-5 years, this amount can reach 30-501 TP3T of the original tax amount.

- Administrative penalties: A fine of 20% will be imposed on the amount of underdeclared tax according to Decree 125/2020/ND-CP. In cases considered as tax evasion (due to intentional falsification of documents), the penalty may range from 1 to 3 times the amount of tax evaded.

Excluding interest expense (EBITDA Risk)

When the national dossier is rejected, the determination of related parties may be broadened or altered in nature. This directly affects the control of interest expense (30% EBITDA) under Article 15 of Decree 132. Businesses may be disqualified from deducting billions of VND in reasonable interest expense simply because the dossier fails to prove the objectivity of related-party debt transactions.

Double Taxation Risk

If profits in Vietnam are assessed to be inflated, but the affiliated company abroad has already paid taxes on that profit, the company will be subject to double taxation. Resolving this through a Double Taxation Avoidance Agreement (MAP) is extremely complex, costly, and takes many years to process.

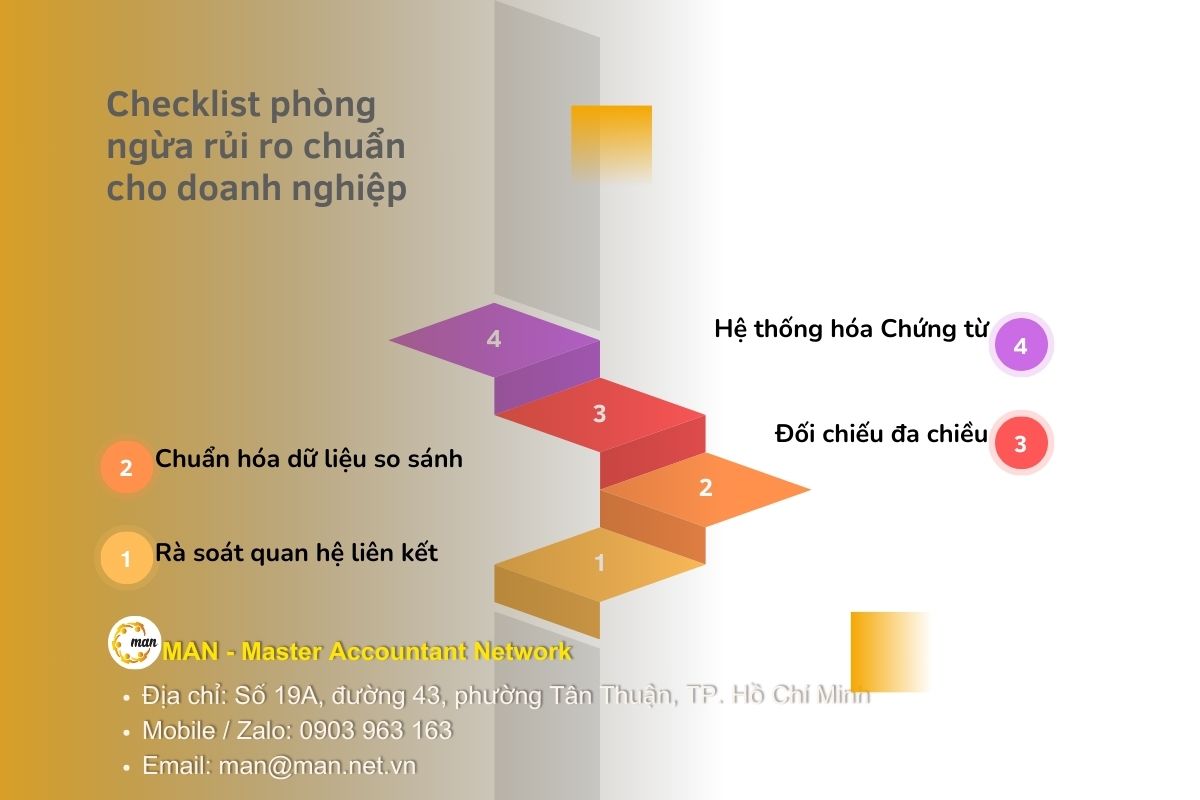

Standard risk prevention checklist for businesses

To minimize risks when preparing a Country Profile, your company should follow these four steps:

- Review of related party relationships: Carefully examine the relationships in accordance with Article 5 of Decree 132/2020/ND-CP. Pay particular attention to the new regulations on the debt-to-equity ratio for related parties that are credit institutions in Decree 20/2025/ND-CP.

- Standardize comparative data: Use globally reputable data sources such as Orbis, Moody's, or reports from the Tax Administration. Ensure that comparable companies have been excluded from any anomalies.

- Multidimensional reconciliation: Ensuring absolute consistency between the Local File, the Master File, and the Country-by-Country Report of Profits (CbCR). Discrepancies between these layers of documentation are a "red flag" for tax inspectors.

- Document systematization: Store all exchanged emails, contracts, invoices, and logical price analyses for easy presentation.

Conclude

In the context of increasingly in-depth audits of related-party transaction pricing, identifying and effectively controlling risks when preparing the National Tax File is no longer a procedural requirement, but has become a crucial part of a company's tax management strategy. A well-prepared National Tax File, with consistent data, accurately reflecting the nature of transactions, and complete supporting documentation, will be a "shield" helping businesses minimize the risk of tax assessments, back taxes, and penalties in 2025 and subsequent years.

However, for large-value or complex related-party transactions, self-preparation without an independent perspective can easily lead to potential risks. Businesses should proactively review their national tax filings from the beginning of the period, or consult with experienced tax consultants such as MAN – Master Accountant Network, to promptly identify weaknesses and strengthen compliance before tax authorities conduct audits. Timely preparation can help businesses avoid unnecessary financial consequences and operate with greater peace of mind in the long term.

Contact MAN – Master Accountant Network for timely advice and support.

Contact information MAN – Master Accountant Network

- Address: No. 19A, Street 43, Tan Thuan Ward, Ho Chi Minh City

- Mobile/Zalo: 0903 963 163 – 0903 428 622

- Email: man@man.net.vn

Content production by: Mr. Le Hoang Tuyen – Founder & CEO MAN – Master Accountant Network, Vietnamese CPA Auditor with over 30 years of experience in Accounting, Auditing and Financial Consulting.

Editorial Board of MAN – Master Accountant Network