The net profit margin method (TNMM) is currently the central tool in the global transfer pricing system, widely applied by the OECD and the Vietnamese tax authorities thanks to its flexibility and high reliability. In the context of increasingly strict tax administration, especially under the impact of BEPS and Decree 132/2020/ND-CP, enterprises not only need to understand the net profit margin method correctly but also need to implement it according to international standards to protect their tax position and minimize the risk of collection. The following article provides in-depth analysis, based on official references and practical experience, to help enterprises grasp the nature, application process and requirements in using the net profit margin method of related-party transactions accurately and sustainably.

Definition of net profit margin method

The net profit margin method (TNMM) is a method of determining the appropriate price or profit margin for a related party transaction by comparing the net profit margin (Net Profit Indicator) achieved from that transaction with the net profit margin achieved by comparable independent companies in comparable transactions.

The key difference between the Net Profit Margin Method and the Resale Price Method and the Cost Plus Method is that it relies on Net Profit at the transaction or overall business level, rather than Gross Profit. This makes the Net Profit Margin Method less susceptible to small differences in the functions, assets, or accounting standards of independent companies.

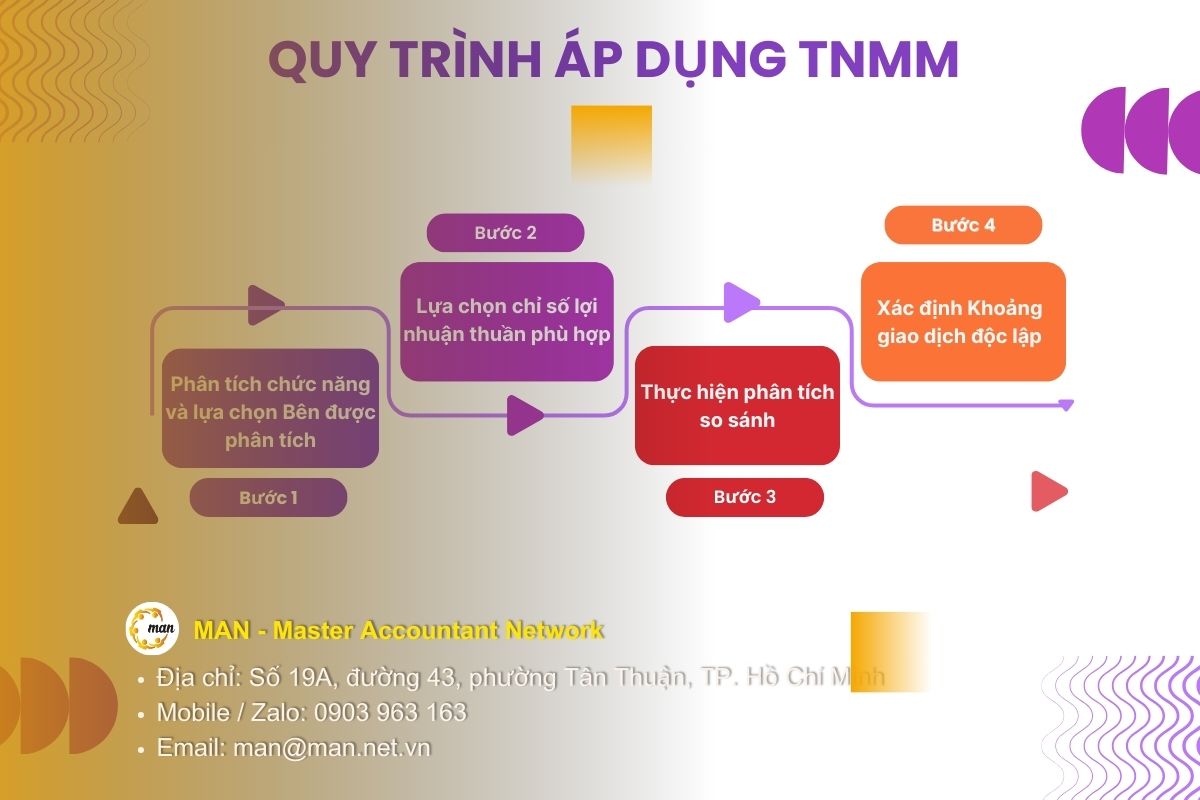

Procedure for applying the net profit margin method

Applying the net profit margin method in related party transactions requires a rigorous analytical process, which includes the following four main steps:

Step 1: Functional Analysis and Selection of the Analyzed Party

This is the most important and decisive step in the entire process of applying the net profit margin method.

- Functional analysis: This analysis specifically identifies the functions performed, assets used (including intangible and tangible assets), and risks borne by each party participating in the related-party transaction.

Select the Tested Party, specifically:

- Principle: Choose the party to the related-party transaction that has less complex operations, lower risks, and holds fewer unique intangible assets.

- Rationale: When selecting a less complex party, it is easier and more accurate to search and compare data with independent companies (with simple functions), which helps to increase the reliability of the net profit margin method in related-party transactions. A typical example is selecting a toll manufacturer or a limited risk distributor as the Tested Party.

Once the in-depth Functional Analysis has been completed and the Tested Party has been identified with clearly defined functions, assets and risks, the next step is to select the most appropriate Net Profit Index (NPI). This is the core financial measure to compare economic performance, ensuring the accuracy of the net profit margin method in related-party transactions.

Step 2: Choose the appropriate Net Profit Indicator (NPI)

The selection of an NPI should be based on the results of the Functional Analysis in Step 1. The ideal NPI is the one that best reflects the relationship between the functions, assets, and risks being analyzed.

Common NPIs in the transfer pricing net profit margin method:

| Net Profit Index (NPI) | Fit |

| Net Profit Margin on Total Cost. | Manufacturer, Service Provider: Demonstrates cost management effectiveness. |

| Net Profit Margin on Sales. | Low Risk Distributor, Service Provider: Represents the percentage of profit retained from each dollar of revenue. |

| Net Profit Margin on Operating Assets. | Asset-intensive parties: Demonstrate efficient use of capital or assets |

The above net profit indexes (NPI) are the key basis for choosing the appropriate measurement tool when applying the net profit margin method. Choosing the right NPI helps to accurately reflect the nature of the functions and risks of the analyzed party, while ensuring the comparison results are consistent, transparent and in compliance with OECD standards as well as Decree 132/2020/ND-CP.

Step 3: Conduct comparative analysis

This is the process of searching, screening and adjusting data from independent companies to determine independent profit margins.

- Search: Use international financial databases (such as Amadeus, Orbis, S&P Capital IQ) to search for independent companies with similar functions and business lines as the selected Analyzed Party.

Conduct Qualitative and Quantitative screening, specifically:

- Qualitative Screening: Eliminate companies that have significant related-party transactions, have very different operations, are in the process of bankruptcy/merger, or hold unique intangible assets.

- Quantitative Screening: Applies criteria of revenue, asset size, and continuity of data. Usually requires financial data for 3 consecutive years.

Data Collection and Adjustments such as Financial data (Income Statement, Balance Sheet) are collected to calculate NPI for each comparable company.

Step 4: Determine the Independent Trading Range

After calculating the NPIs of all the screened comparison companies, arrange the NPIs in ascending order and use the Quartiles statistical analysis. The independence interval is usually determined from:

- First quartile (Q1): Reasonable minimum return.

- Third quartile (Q3): Reasonable maximum profit level.

Compare and conclude:

- Compare the NPI of the Tested Party with the Independent Range (Q1 – Q3).

- If NPI is between Q1 – Q3: The related party transaction price is considered to comply with ALP (In accordance with the related party transaction net profit margin method).

- If NPI is outside the range: The enterprise must adjust the related party transaction price to bring NPI to the Median value of the independent range (according to Vietnam's regulations in Decree 132/2020/ND-CP).

However, to ensure absolute fairness and accuracy in comparison, especially when independent companies have differences in business cycles and credit terms, making adjustments is a professional requirement that cannot be ignored.

Adjustment of working capital

A highly specialized aspect of the net profit margin method in related party transactions is the making of adjustments to enhance the accuracy of comparisons.

Because NPI of independent companies can be affected by differences in Operating Assets (such as Receivables, Inventory, Payables), especially working capital.

A Working Capital Adjustment (WCA) is performed to remove the effects of these differences, allowing for a more “on-par” comparison. This adjustment accounts for the difference in cost of capital incurred from holding various working capital items between a selection of Analysed Entities and the comparable company.

After understanding the complex process and technical requirements such as Working Capital Adjustment, MAN – Master Accountant Network will analyze the outstanding advantages that have made the net profit margin method of related transactions become the top choice, while pointing out the limitations that need to be managed.

Advantages and disadvantages of net profit margin method

Once you have identified the appropriate net profit margin and have a good understanding of how the net profit margin method works in practice, the next step is to comprehensively assess the advantages that make this method widely used, while identifying potential limitations that may affect the reliability of the analysis. This will help businesses gain a deeper understanding of the method's applicability in each specific context.

Outstanding advantages

Below are the outstanding advantages that make this method a priority for experts and tax authorities:

- Difference Resistance: The net profit margin method is less affected by differences in functions, assets (other than significant intangible assets), or national accounting rules for gross-level items (such as manufacturing costs, cost of goods sold) than CUP, Resale Price, and Cost Plus. This makes the net profit margin method in related-party transactions a safer choice.

- Easy to Find Comparable Data: Because of its focus on net profit, the net profit margin method allows for the use of comparable companies that are slightly less similar at the specific transaction level, as long as the overall function and risk are comparable.

- High flexibility: The net profit margin method in related-party transactions can be widely applied to most types of internal business transactions, from manufacturing, distribution, to service provision.

- Widely accepted: This is a method widely accepted by both the OECD and the Vietnamese tax authorities and is often the default method when CUP data is not available.

However, although the net profit margin method in related-party transactions offers many advantages in terms of flexibility and the ability to cope with complexities in valuation, its application is not entirely risk-free. To ensure compliance and effectiveness, businesses need to be aware of the following potential limitations:

Limitations and risks to note

However, this method also has some limitations and risks that businesses need to pay special attention to:

- Sensitivity to Firm-Level Data: The net profit margin method uses net profit data for an entire independent firm. If that independent firm engages in many different types of transactions (not just the transaction being analyzed), the NPI may be biased.

- Accurate Functional Analysis Required: Although less sensitive at the granular level, the identification of functions and risks still needs to be extremely accurate in order to select the appropriate NPI and Tested Party. Failure at this step will result in the application of the net profit margin method being rejected.

- Reliance on public financial data: Finding high-quality comparative data, especially in emerging markets like Vietnam, remains difficult and costly.

Although the transfer pricing net profit margin method offers many advantages in terms of flexibility and ability to cope with valuation complexities, to effectively manage the above limitations and risks, the application of this method needs to be underpinned by practical experience and deep expertise.

Practical experience and delegation

For a Transfer Pricing dossier using the net profit margin method to be considered to comply with high standards, a combination of deep technical knowledge and practical experience is required.

Experience in selecting the Tested Party

Experience shows that choosing a Tested Party needs to be a strategic decision:

- Low-Risk Manufacturing or Distribution: In most cases, companies that only perform simple manufacturing, processing, or basic distribution functions (do not hold brands, do not take on large market risks) are optimal choices for Tested Parties. Their profits are expected to be stable and comparable.

- Avoid Selecting Intangible Asset Owners: Companies holding significant intangible assets (such as patents, global brands) should never be selected as the Tested Party, as it is difficult to find reasonable independent comparable data.

Expertise in Service Transaction Processing

The net profit margin method of related-party transactions is the primary method used to value internal service transactions, especially low value-added services.

- Low Value Added Services: OECD and Decree 132/2020/ND-CP stipulate that the standard profit margin for value added services is 5% on total costs. However, if businesses do not want to use this simple margin, they must apply the net profit margin method and demonstrate that another standard profit margin is reasonable.

- Cost Allocation: Expertise is required to properly allocate general operating costs to specific related transactions, ensuring that NPI calculations are not biased.

Authority and credibility

The authority of a report using the net profit margin method is reinforced by strict compliance with the Transfer Pricing Documentation requirements.

- Local File: Required, detailing the Functional Analysis (step 1) and the results of steps 3 and 4 using the transfer pricing method.

- Master File: Provides a comprehensive picture of multinational enterprises (MNEs) and the group's Transfer Pricing strategy.

Accountability: The documentation must be sufficiently transparent and detailed to be easily understood and accepted by the tax authorities. Any adjustments and the reasons for choosing the net profit margin method must be clearly explained.

TNMM in Vietnamese Tax Law

Decree 132/2020/ND-CP specifies the application of Transfer Pricing methods, including the transfer pricing net profit margin method.

Regulations on Methods and Priority Levels

Decree 132 stipulates that, when applying TP methods, enterprises must comply with the order of priority. Although CUP (Comparable Uncontrolled Price Method) is always the top priority, but due to the practical difficulty of finding a perfect CUP, the net profit margin method of related-party transactions is often the next alternative after excluding Resale Price and Cost Plus due to their limitations.

Independent Trading Space Requirements

Vietnamese tax law clearly stipulates the use of Quartile statistical analysis:

- Reasonable Range: The independent range is determined from the First Quartile (Q1) to the Third Quartile (Q3) of the NPI of the comparison companies.

- Mandatory Adjustment Regulation: If the NPI of the Tested Party is outside the range Q1 – Q3 (i.e. lower than Q1 or higher than Q3), the enterprise must self-adjust to bring the NPI to the Median Value. This is a strict regulation in Vietnam, unlike some countries that only require adjustment to any point in the range.

Benefits of following the net profit margin method

Applying the standard method of net profit margin of related-party transactions according to Decree 132/2020/ND-CP helps businesses:

- Minimize Tax Risk: Proactively demonstrate that your NPI is within independent limits, avoiding tax arrears and penalties due to adjustments by tax authorities.

- Ensuring Financial Reporting Integrity: Profit margins accurately reflect the company's role and risks within the group's value chain.

Conclusion and recommendations

The net profit margin method in related-party transactions (TNMM) is a mainstay in the global Transfer Pricing system, trusted by tax authorities and multinational corporations for its flexibility and relatively high reliability.

However, the success of applying the transfer pricing method depends entirely on the quality of the Functional Analysis and the accuracy of the Benchmarking process.

Therefore, to ensure the effective application of the net profit margin method on related-party transactions, enterprises need to prioritize:

- Prioritize Functional Analysis: Always invest time and resources to conduct an extensive Functional Analysis. Poor analysis is the number one reason why Valuation Documents are rejected.

- Regular updates: Regularly update comparative data (at least every 3 years) and review the chosen methodology to ensure its suitability to changing market conditions.

- Documentation Ready Justification: Ensure your Valuation Documentation is not only compliant but also transparent enough to clearly explain to the tax authorities the reasons for choosing the net profit margin method and the adjustments made.

- Special Financial Risk Management: Focus on compliance with complex regulations such as limits on interest expense in related party transactions according to Decree 132/2020/ND-CP to avoid significant tax adjustments.

- Consult an expert: To ensure compliance with both OECD standards and specific Vietnamese regulations, consulting or hiring an experienced transfer pricing consultant is essential to minimize the risk of tax collection.

Contact MAN – Master Accountant Network now for advice and support!

Contact information MAN – Master Accountant Network

- Address: No. 19A, Street 43, Tan Thuan Ward, Ho Chi Minh City

- Mobile/Zalo: 0903 963 163 – 0903 428 622

- Email: man@man.net.vn

Content production by: Mr. Le Hoang Tuyen – Founder & CEO MAN – Master Accountant Network, Vietnamese CPA Auditor with over 30 years of experience in Accounting, Auditing and Financial Consulting.

Editor MAN – Master Accountant Network