On November 5, 2020, the Government officially issued Decree 132/2020/ND-CP, establishing a strict legal framework for tax management of enterprises with related-party transactions in accordance with international practices. Since then, declaring Appendix IV of the Country-by-Country Report on Profits has become a mandatory requirement and is also a content that many businesses find confusing during implementation.

Many businesses face difficulties in determining the correct scope of information to declare, how to present data, and its conformity with transfer pricing documentation. To assist businesses in accessing and complying with regulations, MAN – Master Accountant Network shares guidance on declaring Appendix IV under Decree 132/2020/ND-CP, helping businesses understand the nature of the regulations, comply with legal requirements, and minimize risks during tax audits and inspections.

What is Country-by-Country Reporting?

The Country-by-Country Report (CbCR) is a mandatory tax report for multinational corporations, designed to provide tax authorities with an overall view of the distribution of profits, revenue, and tax obligations across the countries where the corporation operates.

Essentially, a country-by-country earnings report is a "global earnings map" for a multinational corporation, clearly demonstrating:

- Revenue is generated in each country.

- Profit before tax

- Corporate income tax paid and payable

- The scale of operations is measured by the number of employees, capital, and assets.

Purpose of the Country-by-Country Report

This report was prepared in accordance with OECD recommendations within the framework of BEPS – Combating Base Erosion and Profit Shifting, with the following main objectives:

- Enhancing tax transparency for multinational corporations.

- Assisting tax authorities in assessing transfer pricing risks.

- Prevent the practice of transferring profits to countries with low tax rates.

To provide a basis for the exchange of tax information between countries.

Why do businesses need to understand this report?

The preparation and reporting of country-by-country profit is not merely a procedural matter, but also directly impacts:

- Level of tax law compliance

- The likelihood of being classified as high-risk during a tax audit.

- The corporation's reputation and financial transparency.

Understanding the true nature of country-by-country profit reporting will help businesses proactively declare Appendix IV, ensuring compliance with Decree 132 and minimizing tax risks in the long term.

Tax period

Record the information corresponding to the tax period of the Corporate Income Tax Return. The tax period is determined according to the provisions of the Corporate Income Tax Law..

General information of the taxpayer

From item [01] to item [10] record information corresponding to the information recorded in the Corporate Income Tax Final Settlement Declaration.

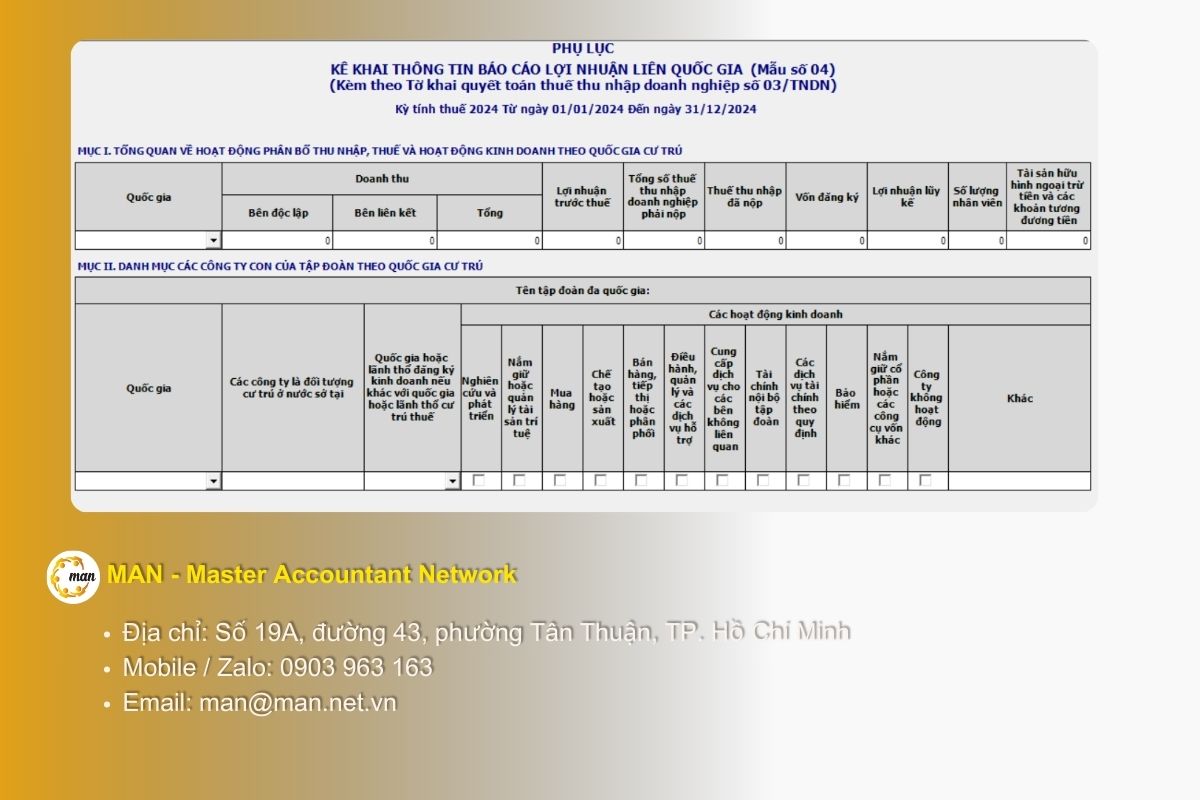

An overview of income distribution, tax obligations, and business activities by country of residence.

The declared figures must be converted and presented in Vietnamese Dong, in accordance with current regulations of the corporate accounting system. If related parties within the same group use different fiscal years, the country-by-country profit report shall be prepared based on data and information from the fiscal year immediately preceding the taxpayer's tax period.

National target This section specifies the country or territory where the related parties are identified as residents, and includes the location of their permanent establishment or production/business facility through which the related parties conduct all or part of the taxpayer's and related enterprises' production and business activities within the same group. This also applies in cases where the related parties' specific country or territory of residence cannot be identified.

- In cases where the ultimate parent company and its affiliated parties have tax obligations in multiple countries, the determination of the tax residence country must be carried out in accordance with the provisions and guidance of the relevant Double Taxation Avoidance Agreement.

- In cases where a tax agreement has not been signed between the countries or territories involved, businesses shall declare taxes according to the following principle: identify and record the country or territory where the related party is registered for business or the country or territory where the related party has a production or business facility, through which it carries out part or all of the production or business activities arising in the respective country or territory.

The "Revenue" target To be The total value of all income received during the period from related parties and independent parties, excluding dividends and profits distributed from related parties, includes:

- Independent party: Represents the total revenue generated in each country or territory where the affiliated parties within the group reside, derived from transactions with unrelated entities.

- Related parties: This section summarizes and records all revenue generated from transactions between related parties within the same group, categorized by country or territory where the related parties reside.

- Total revenue is determined by adding up all revenue generated from transactions with independent parties and revenue from transactions with related parties, corresponding to the figures recorded in these two columns.

The "Profit before tax" indicator This refers to recording the total pre-tax accounting profit of the related parties of a multinational corporation in the country or territory where it is located.

The indicator "Total corporate income tax payable" This involves recording the total corporate income tax obligations or equivalent taxes incurred by related parties within a multinational corporation in the country or territory of their residence. Simultaneously, it fully reflects any taxes similar to corporate income tax (e.g., contractor tax) incurred and payable in other countries or territories where the related parties operate and establish tax obligations.

The total corporate income tax liability is determined in accordance with the accounting system applied in the country of residence of the related party, which may be on a cash basis or an accrual basis. If the tax is determined on a cash basis, the enterprise must specify the method applied in the corresponding explanatory notes.

The indicator "Income tax paid" This is to record the total income tax paid by all affiliated parties of the group.

In cases where related parties have already paid corporate income tax to foreign contractors (or taxes of an equivalent nature) in a country or territory other than their place of residence, the amount of contractor tax paid will be added to the total corporate income tax paid.

"Registered capital" indicatorRecord the total amount of committed investment capital actually disbursed by affiliated parties of the multinational corporation in their place of residence.

The "Cumulative Profit" indicator: Record the total accumulated undistributed after-tax profits of all associated parties of the group in the country at the end of the period.

Target "Number of employees": Record the average total number of employees employed by all affiliated parties.

The indicator "Tangible assets excluding cash and cash equivalents": Record the total value of assets of related parties, including key asset groups such as tangible fixed assets, fixed assets leased under financial arrangements, investment properties, and long-term assets under investment or construction.

See also: Instructions for completing Appendix I

List of the Group's subsidiaries by country and territory of residence.

To clarify the list of companies within the group by country and territory of residence, the enterprise needs to declare each item in detail to fully reflect the residency status, affiliated legal entity, and scope of business operations of each unit within the group, specifically as follows:

- National expenditure: Fill in similarly to what was declared in the section "Overview of income distribution, tax obligations and business activities by country of residence".

- The "Companies that are residents of the host country" field: Clearly state the legal name of each affiliated entity belonging to the ultimate parent company, which is obligated to declare and pay corporate income tax (or taxes of an equivalent nature) according to the laws of the country or territory where those entities are located.

- The field "Country or territory of business registration if different from country or territory of residence": List the name of the country or territory where the group's subsidiaries are registered, which is different from the country or territory of residence.

- The "Business Activities" indicator: The parent company is responsible for identifying and classifying the business functions of each affiliated entity. Based on this, the company marks an "x" in the appropriate boxes under "Business Activities" for each listed function. If an affiliated entity performs two or more functions, the parent company must mark all boxes corresponding to the functions performed by that affiliated entity.

See also: Instructions for declaring global tax returns on the HTKK system.

Businesses can refer to the detailed guidelines on declaration of related party transactions To understand the implementation process, how to prepare appendices according to Decree 132, as well as important notes to ensure compliance with regulations and minimize tax risks.

Conclude

In summary, preparing and declaring Appendix IV of the Country-by-Country Report on Related Parties is not only a requirement to comply with Decree 132/2020/ND-CP, but also reflects the level of transparency and tax management capacity of enterprises in the context of integration. By correctly understanding the nature, accurately identifying the operational functions of related parties, and fully declaring information for each country of residence, enterprises will proactively control risks and minimize difficulties during tax audits and inspections.

To ensure a smooth and consistent process with the transfer pricing documentation, businesses should review internal data early and update their in-depth guidance. For detailed support, partnering with a professional consulting firm like MAN – Master Accountant Network will help businesses optimize their documentation, ensure compliance, and significantly save time and resources during the filing process.

Link to the sample form for Appendix IV: Appendix IV International Profit Report

Contact information MAN – Master Accountant Network

- Address: No. 19A, Street 43, Tan Thuan Ward, Ho Chi Minh City

- Mobile/Zalo: 0903 963 163 – 0903 428 622

- Email: man@man.net.vn

Content production by: Mr. Le Hoang Tuyen – Founder and CEO of MAN – Master Accountant Network, CPA Vietnam with over 30 years of experience in accounting, auditing, and financial consulting.

Editorial Board of MAN – Master Accountant Network