In the context of increasingly transparent international taxation and increased regulatory scrutiny of related-party transactions, global filing has become crucial for multinational corporations. A well-prepared global filing not only helps businesses comply with regulations but also ensures business compliance. Decree 132/2020/ND-CP BEPS Action 13 is not only a strategic tool for transparent business models, tax risk management, and profit optimization. This article provides detailed guidance and updates on international standards, helping you understand, prepare, and file effective global filings, ensuring compliance with the law while strengthening your global competitive position.

What is a global profile?

A Master File is a high-level document designed to provide an overview of a multinational corporation's (MNE) global business operations, including its organizational structure, overall value chain, key intangible assets, internal financial activities, and global financial and tax situation.

The primary purpose of filing the Global File is to assist tax authorities in quickly and effectively assessing transfer pricing risks, while providing a basis for member companies to demonstrate compliance with independent market principles.

The regulations on global documentation were first standardized in OECD BEPS Action 13 (Related-Party Transactions and Documentation) and incorporated into Vietnamese domestic law through Decree 132/2020/ND-CP (replacing Decree 20/2017/ND-CP).

Tax filing period

Businesses need to record complete information appropriate to the corresponding tax period in the Corporate Income Tax Return. The determination of the tax period is carried out in accordance with the provisions of the Corporate Income Tax Law and related guiding documents, ensuring accuracy, consistency, and compliance with current tax laws.

General information of the taxpayer

The indicators from [01] to [10] are declared based on the data declared in the Corporate Income Tax Final Settlement Declaration, ensuring consistency, accuracy and uniformity between tax records. Businesses need to carefully compare the information reflected in these indicators to ensure that the content submitted to the tax authority is completely consistent, thereby minimizing the risk of discrepancies and problems arising during tax inspection and audit.

Download the application form:

| Global Profile |

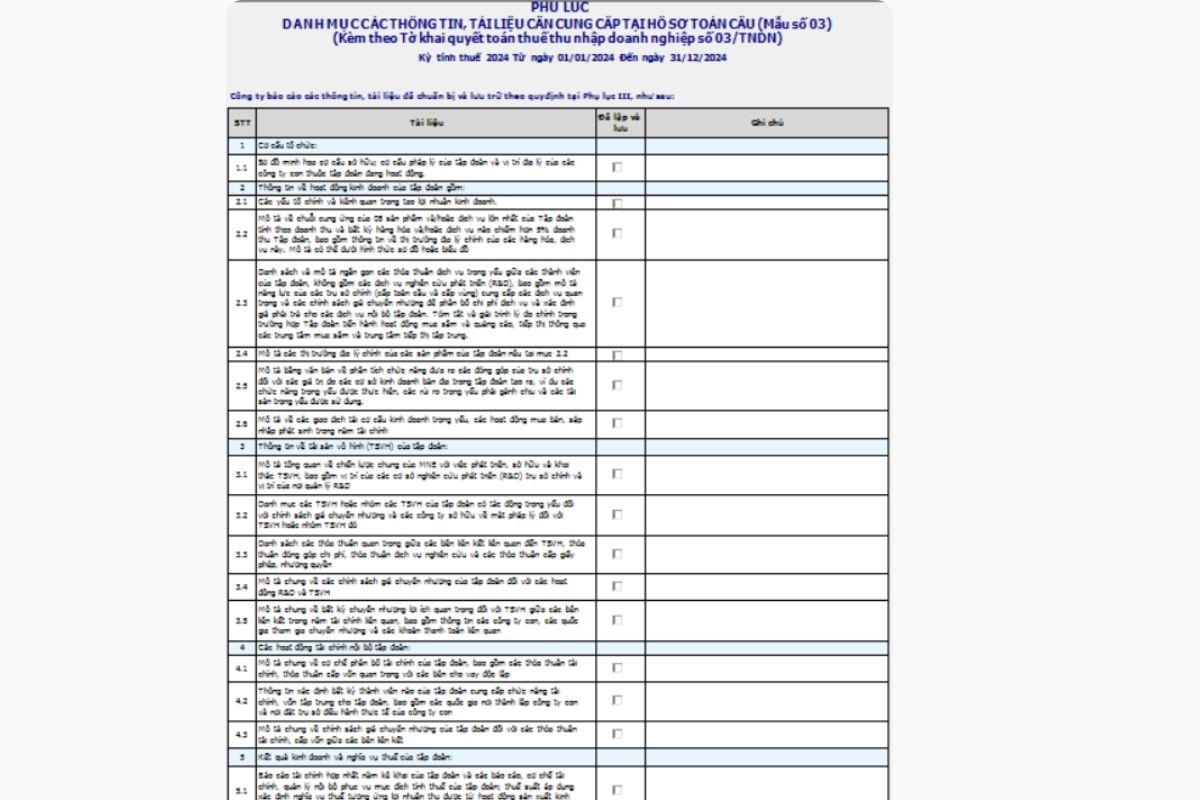

Declare the information and documents that have been prepared and stored in the Global File.

To accurately and properly file global tax returns, businesses first need to gather complete information at the corporate level. This data is usually provided directly from the parent company or through internal records and reports of the multinational corporation. Based on these official documents, businesses review, compare, and select appropriate content, ensuring that each item declared accurately reflects the operating model, organizational structure, and related-party transaction policies of the entire group. Relying on a centralized and controlled source of information not only enhances the reliability of the filings but also minimizes the risk of discrepancies during the filing process and when dealing with tax authorities.

Organizational Structure

In the process of filing global tax returns, businesses need to create a diagram that fully and consistently shows the ownership structure and legal structure of the entire group. This diagram must clearly reflect the capital relationship and control between the parent company and its subsidiaries, while also accurately identifying the geographical location where each member unit operates. Transparently presenting the organizational structure and global presence not only helps tax authorities quickly understand the group's operating model, but also serves as a crucial basis for assessing related-party transaction risks and the level of compliance with independent market principles.

Information about the Group's business operations

In the process of filing a global tax return, the complete and systematic presentation of information regarding the business model, value chain, and internal transactions plays a crucial role in helping tax authorities accurately assess the nature of a multinational corporation's operations. The table below summarizes the key information groups that need to be described in the Global Tax Return, along with compliance objectives and risk management implications, to support businesses in preparing consistent, transparent, and compliant returns in accordance with the BEPS standard and Decree 132/2020/ND-CP.

| Content Group | Requirements in the Global Profile declaration | Purpose and risk management |

| Profit-generating factors and business channels | Present the core elements that generate the group's profits and key business channels, reflecting its operating model and long-term competitive advantages. | This helps tax authorities understand the profit motives and the fairness of allocating business results among related entities. |

| Key product and service supply chain | Describe the supply chain of the 5 products or services with the highest revenue and the products or services accounting for more than 51% of the total consolidated revenue, along with information on the main geographic markets; this can be presented using diagrams or charts. | Clearly identifying where economic value is created helps mitigate the risk of misjudging the functions and roles of units within the corporation. |

| Key Internal Services Agreement | List and briefly describe the key service agreements between members of the group (excluding R&D), including the capabilities of the global and regional headquarters in providing services. | Demonstrate the actual service nature and business necessity of related-party transactions. |

| Service pricing policy and cost allocation | Present the transfer pricing policy used to allocate service costs and determine the fees payable for internal services; explain the reasons why the corporation conducts procurement, advertising, and marketing through centralized centers. | Ensuring compliance with independent market principles and minimizing the risk of cost adjustments during tax audits. |

| Key geographic markets | Describe the key geographic markets for the products and services mentioned in the supply chain section, including the strategic role of each market in the group's revenue and growth. | Assisting tax authorities in assessing the consistency between business operations and financial results in each country. |

| Analyzing the functions and contributions of the headquarters. | Present a written functional analysis, clarifying the key functions, major risks, and significant assets undertaken by the head office, as well as the level of value contribution from local units. | It serves as a basis for determining a fair distribution of profits and protecting the group's pricing perspective on related-party transactions. |

| Restructuring and M&A in the fiscal year | Describe the significant business restructuring transactions, mergers and acquisitions that occurred during the fiscal year, and their impact on the value chain and related-party transactions. | This helps tax authorities fully assess the impact of strategic changes on tax obligations and profit allocation. |

By systematizing the above information, businesses can ensure complete and consistent global filings that accurately reflect the economic nature of related-party transactions within the group. Standardizing information by content group not only helps meet legal compliance requirements but also creates a solid foundation for managing tax risks, proactively explaining matters to tax authorities, and enhancing transparency in cross-border business operations.

Internal financial activities of the Group

In the global filing process, the company needs to describe an overview of the Group's financial allocation mechanism, including how capital is raised, managed, and allocated among its member units:

- Clarify key financial agreements with independent lenders such as banks, credit institutions, or external financial institutions.

The global financial disclosure statement must specifically identify the unit within the Group that performs the financial function or plays a central funding role.

- Specify the subsidiaries involved.

- Identify the country of establishment and the actual location of the head office of each unit performing financial functions.

When filing Global Documents, it is necessary to present the transfer pricing policy applied to internal financial transactions between related parties.

- Describe the principles for determining interest rates, guarantee fees, and funding conditions.

- Ensure that the terms of the transaction comply with the Arm's Length Principle and are consistent with the Group's overall financial policy.

The Group's business results and tax obligations.

In the process of filing global financial statements, businesses must prepare consolidated financial statements for the filing year, fully reflecting their financial position and operating results on a global scale.

- This includes reports, financial mechanisms, and internal management procedures applied by the corporation for tax purposes, thereby demonstrating how profits and expenses are controlled and allocated among member units.

- The documentation needs to clarify the applicable tax rates to determine the corresponding tax obligations for the portion of profits arising from the business activities of related parties with related-party transactions to the taxpayer, ensuring compliance with the arm's-length principle.

- The global filing also requires a list and brief description of all advance pricing agreements (APAs), including unilateral APAs signed between the business and tax authorities in the countries concerned.

- In addition to the APA, businesses need to present other key tax policies related to income allocation across countries, to help tax authorities assess the consistency and transparency of the corporation's global tax strategy.

Conclude

Global filing is not just about legal compliance; it's also a crucial foundation for businesses to demonstrate transparency in tax management and related-party transactions globally. A well-prepared, consistent, and compliant global filing (BEPS) and Decree 132/2020/ND-CP will help businesses proactively control risks, minimize the possibility of tax assessments, and create a strong advantage during tax audits and inspections.

In the context of increasingly stringent compliance requirements, integrating global filing with the process is crucial. declaration of related party transactions A systematic and standardized approach will help businesses build a comprehensive tax defense documentation system.

If your business needs to review, finalize, or optimize its global tax filings for the upcoming tax period, partnering with MAN – Master Accountant Network's experienced team will save you time, ensure accuracy, and enhance your tax defenses. This is the perfect time to review all related-party transaction records and prepare for compliance requirements in 2026 and beyond.

Contact information MAN – Master Accountant Network

- Address: No. 19A, Street 43, Tan Thuan Ward, Ho Chi Minh City

- Mobile/Zalo: 0903 963 163 – 0903 428 622

- Email: man@man.net.vn

Content production by: Mr. Le Hoang Tuyen – Founder & CEO MAN – Master Accountant Network, Vietnamese CPA Auditor with over 30 years of experience in Accounting, Auditing and Financial Consulting.

Editorial Board MAN – Master Accountant Network