In the context of Vietnam's tax authorities intensifying inspections of related-party transactions and cross-border information exchanges, accurately identifying entities that fail to prepare CbCR reports is crucial not only for businesses to comply with regulations but also for avoiding the risk of tax assessments and administrative penalties. In reality, many FDI businesses, even those not required to prepare CbCR reports, are still questioned due to misunderstandings of revenue thresholds, information exchange mechanisms, or notification obligations. This article, based on... Decree 132/2020/ND-CP And the updated tax management practices for 2025 will help businesses clearly identify whether they are exempt from preparing CbCR reports, along with important notes to demonstrate and defend their compliance position before the tax authorities.

What is Country-by-Country Reporting?

Country-by-Country Reporting (CbCR) This is an important part of Action 13 of the OECD-initiated Revenue Erosion and Profit Shifting (BEPS) project. In Vietnam, this report is detailed in the Transfer Pricing Documentation, alongside the Local File and the Master File.

The primary purpose of CbCR is to provide tax authorities with a comprehensive picture of the revenue, profits, corporate income tax paid, and core business activities of each entity within a multinational corporation globally. This allows tax authorities to assess transfer pricing risks and improper profit allocation.

Important legal basis

To determine which entities are not required to prepare a CbCR report, businesses need to rely on the following "backbone" legal documents:

- Decree 132/2020/ND-CP: Regulations on tax management for enterprises with related-party transactions. This is the most important document governing all obligations regarding the Country-by-Country Report (CbCR) currently in effect.

- Circulars issued by the Ministry of Finance: Circulars guiding the implementation of the Law on Tax Administration No. 38/2019/QH14.

- International tax agreements: These include the Multilateral Agreement on Exchange of Income Reporting (MCAA), which Vietnam has signed, and Double Taxation Avoidance Agreements (DTAs).

In 2025, the General Department of Taxation of Vietnam will continue to promote automated information exchange, which will directly affect the determination of cases exempt from filing reports domestically.

Who is required to prepare the CbCR report?

To determine if you are exempt from preparing the CbCR report, you first need to check if you fall into the category that requires it. Specifically:

- Taxpayers in Vietnam who are Ultimate Parent Companies (UPEs): Have consolidated global revenue of VND 18,000 billion or more during the tax period.

- Taxpayers in Vietnam with a parent company located abroad: However, the parent company is obligated to prepare the CbCR report according to the laws of the host country AND in cases such as: that country does not have an information exchange agreement with Vietnam, or has an agreement but the automatic information exchange has been suspended.

Note: The deadline for preparing the Country-by-Country Report is before the corporate income tax settlement period, and it must be submitted along with the corporate income tax return.

See details: Instructions for filling out Appendix IV (Form 04/GDLK)

Entities not required to prepare CbCR reports in related-party transactions

Below are specific cases identified as entities not required to prepare CbCR reports according to Article 18 of Decree 132/2020/ND-CP and the updated guidelines of 2025.

Businesses that do not meet the specified revenue threshold.

This is the most common and fundamental requirement. A multinational corporation only incurs the obligation to establish a Consolidated Global Revenue Record (CbCR) if its consolidated global revenue in the preceding fiscal year meets the specified threshold.

- In Vietnam: The threshold is 18,000 billion VND.

- International standard (OECD): The threshold is typically 750 million Euros.

If your company's consolidated global revenue falls below this level, your business automatically becomes exempt from preparing the CbCR report.

Note: This revenue figure is calculated on a global scale for the entire group, not just the revenue of the legal entity in Vietnam.

The ultimate parent company in a country that has an automatic information exchange mechanism with Vietnam.

Even if a corporation has revenue exceeding VND 18 trillion, a business in Vietnam may still be exempt from preparing a CbCR report (i.e., not having to submit a copy in Vietnam) if it meets the conditions for automatic information exchange.

Since Vietnam signed the MCAA, the information exchange mechanism has become more streamlined. If your parent company has submitted a CbCR report to the tax authority of its host country (e.g., Japan, South Korea, Singapore…) and that country has an automatic information exchange agreement with Vietnam, then the Vietnamese tax authority will automatically receive that report through diplomatic channels.

In this case, you are not required to file a CbCR report in Vietnam, but the business must still notify the tax authorities about which entity and where the report was submitted.

In cases where a parent company has submitted the report on their behalf.

If the ultimate parent company does not directly submit the report but the group designates another entity (usually a subsidiary in a country with an information exchange agreement with Vietnam) as the “replacement parent company” to submit the CbCR report, then the business in Vietnam is also exempt from having to prepare the CbCR report.

Conditions for exemption in this case:

- The parent company submitted the report on its behalf within the stipulated deadline.

- The country where the surrogate parent company is located has an automatic information exchange agreement with Vietnam.

- Businesses in Vietnam have submitted notification documents to the tax authorities as required.

Designating a substitute parent company to fulfill the obligation to submit the Transfer Pricing Correspondence Report (CbCR) allows businesses in Vietnam to be exempt from this reporting obligation at the group level. However, in practice, the scope of exemption from this reporting obligation is not limited to the CbCR report, but also extends to cases where businesses are exempt from preparing Transfer Pricing Documentation under Article 19 of Decree 132/2020/ND-CP, if they fully meet the conditions regarding the scale, nature of the transaction, and level of transfer pricing risk.

Businesses are exempt from preparing Transfer Pricing Documentation.

It should be noted that if a business is generally exempt from filing related-party transaction reports, it is also automatically exempt from preparing a CbCR report. These cases include:

- Small scale: Revenue under VND 50 billion and total value of related-party transactions under VND 30 billion in a tax period.

- Purely domestic transactions: Transactions only occur with related parties in Vietnam, with the same corporate income tax rate, and neither party enjoys tax incentives.

- Standard profit margin: Businesses with simple functions, no intangible assets, revenue under VND 200 billion, and achieving a profit margin (EBIT) on revenue within the specified threshold (from 51 TP3T to 151 TP3T depending on the industry).

When a business meets one of these conditions, it can rest assured that it is not required to prepare a CbCR report.

Key tips for optimizing your business.

To ensure compliance and demonstrate professionalism to the tax authorities, businesses that are not required to prepare the CbCR report should pay attention to the following points:

Check residency status and information exchange list.

Don't just assume. Regularly check the list of countries that have signed the MCAA and have actual agreements with Vietnam on the General Department of Taxation's portal. A country may have signed the agreement but not yet activated the automatic exchange mechanism; in that case, you might go from not being required to file a CbCR report to being required to do so.

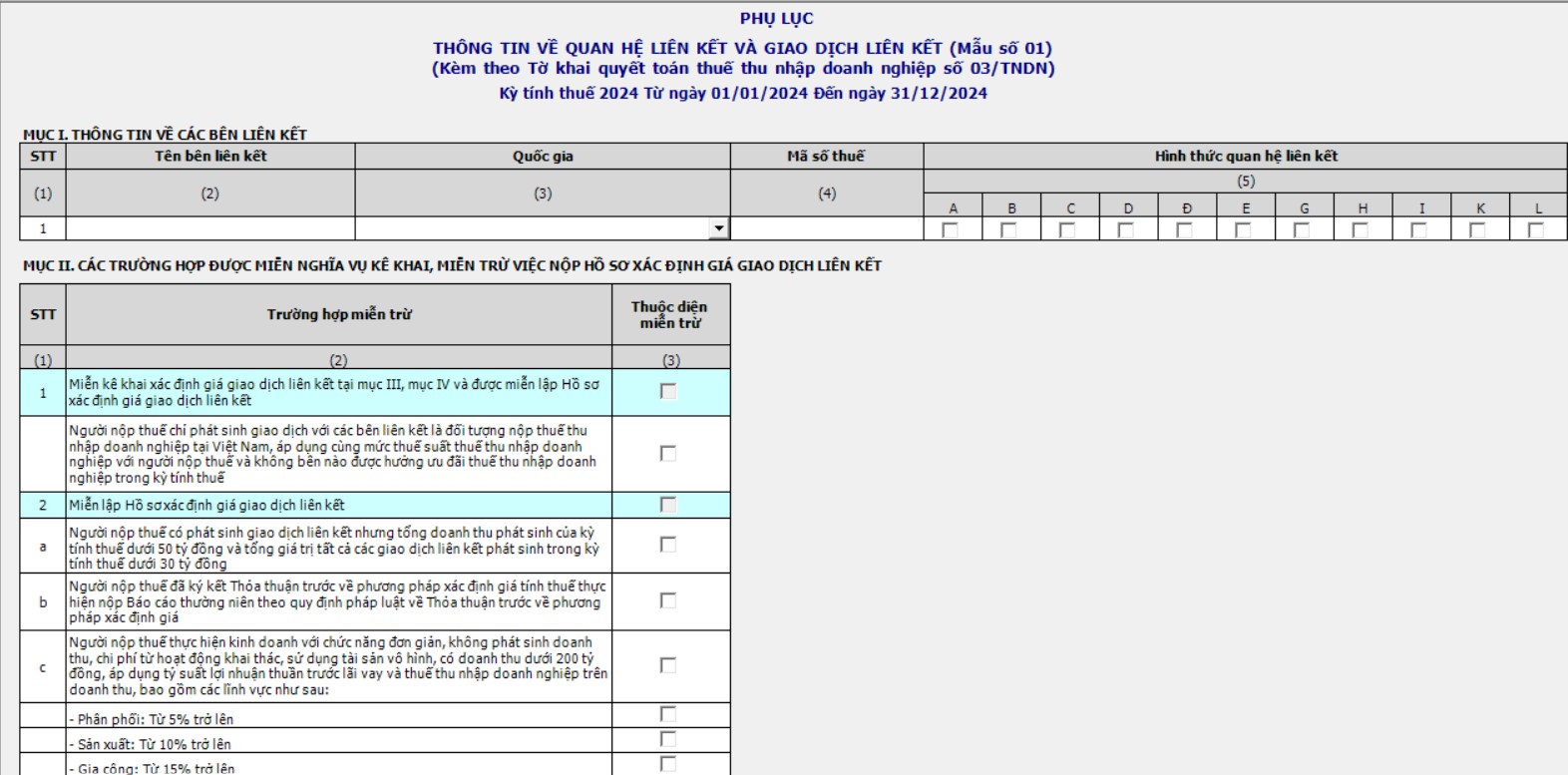

Don't forget to submit Appendix I (Form No. 01/GDLK)

Even if you are not required to file a CbCR report, you are still obligated to declare information about related-party relationships and related-party transactions in Appendix I attached to your corporate income tax return. "Forgetting" to check the exemption box or making false declarations can lead to tax audits and tax assessments.

See details: Instructions for completing the Related Party Transaction Declaration Form.

Archive of explanatory records

The reliability of tax records is demonstrated by the fact that the business has evidence readily available. Please keep this record:

- Consolidated financial statements of the group (to demonstrate revenue below the threshold).

- Confirmation of submission of the CbCR report by the ultimate parent company overseas.

- The notification documents have been sent to the Vietnamese tax authorities.

In fact, the true value is only fully reflected when businesses declare correctly, using the right forms and at the right time as stipulated by the tax authorities. Therefore, to avoid the risk of being questioned or having their exemption rejected, businesses need to understand the declaration guidelines below when exempted from preparing the CbCR report.

Instructions for filing when exempt from preparing the CbCR report.

When a business determines that it is not required to prepare a CbCR report, the declaration process typically follows these steps:

In Appendix I (Form 01/GDLK):

- Identify the affiliated parties and the form of affiliation.

- In Section II (Exemptions), taxpayers should check the box corresponding to the reason they are exempt from filing (including the CbCR report).

If the parent company submits the CbCR report abroad, the enterprise must submit a written notification to the Vietnamese tax authorities before or at the same time as submitting the final tax return.

The deadline for submission coincides with the deadline for submitting corporate income tax returns (usually the last day of the third month from the end of the fiscal year).

Conclusion and recommendations

During peak audit and tax settlement periods, as filing deadlines approach, incorrectly identifying entities that fail to prepare CbCR reports or omitting information on exemptions can lead to unexpected inquiries, inspections, and the risk of tax assessments after settlement. Reviewing CbCR obligations right before the deadline not only helps businesses correct errors in time but also avoids the pressure of rushing to process documents when tax authorities are already involved. This is also an opportune time for businesses to proactively check exemption conditions and standardize explanatory documents, rather than passively explaining after the settlement period.

To accurately determine whether a business is exempt from or required to prepare a CBCR report, the following steps should be taken:

- Review the consolidated group revenue figures at the end of the fiscal year.

- Maintain close contact with the parent company's tax department to obtain evidence of overseas filings.

- In cases of complex ownership structures, consult with professional tax advisors to ensure your business is legally exempt from filing CbCR reports.

Ensuring compliance not only helps businesses avoid penalties but also builds a reputable image in the eyes of regulatory authorities, creating a foundation for sustainable development in the Vietnamese market.

Contact MAN – Master Accountant Network now for timely advice and support.

Contact information MAN – Master Accountant Network

- Address: No. 19A, Street 43, Tan Thuan Ward, Ho Chi Minh City

- Mobile/Zalo: 0903 963 163 – 0903 428 622

- Email: man@man.net.vn

Content production by: Mr. Le Hoang Tuyen – Founder and CEO of MAN – Master Accountant Network, CPA Vietnam with over 30 years of experience in accounting, auditing, and financial consulting.

Editorial Board of MAN – Master Accountant Network