The related-party transaction declaration is a mandatory document that directly impacts the risk of audits and tax collection for all businesses with related-party transactions. Incomplete, incorrect, or inconsistent declarations regarding the determination of transfer pricing can lead to significant adjustment costs for businesses, or even result in tax assessments. In the context of increasingly stringent tax controls under Decree 132/2020/ND-CP, businesses need to understand the regulations, principles, and methods for accurately, transparently, and technically soundly preparing the related-party transaction declaration.

Instructions for preparing the Related Party Transaction Declaration Form

A properly prepared related-party transaction file must always include a Related-Party Transaction Declaration, as this is a key document demonstrating the transparency and compliance level of the business. Preparing this declaration not only helps businesses fully disclose related-party transactions but also significantly reduces tax risks arising during audits and inspections. When information is declared correctly, completely, and consistently with the pricing documentation, businesses will reduce the risk of being assessed taxes and ensure compliance with the requirements of Decree 132/2020/ND-CP.

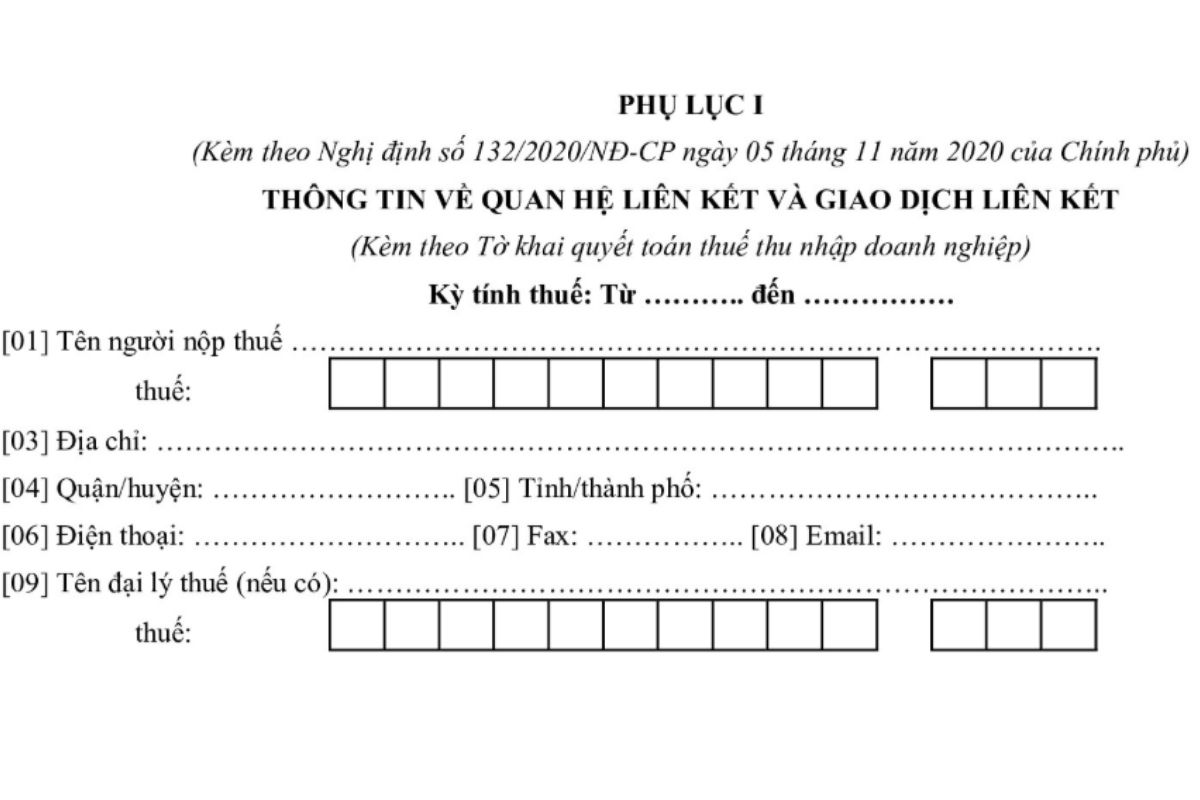

Tax period when filling out the Related Party Transaction Declaration.

A properly prepared related-party transaction file must always include a Related-Party Transaction Declaration, as this is a key document demonstrating the transparency and compliance level of the business. Preparing this declaration not only helps businesses fully disclose related-party transactions but also significantly reduces tax risks arising during audits and inspections. When information is declared correctly, completely, and consistently with the pricing documentation, businesses will reduce the risk of being assessed taxes and ensure compliance with the requirements of Decree 132.

Brief information of the taxpayer

The indicators from [1] to [10] on the Related Party Transaction Declaration form essentially only require the enterprise to provide basic information that has already appeared in the Corporate Income Tax Final Settlement Declaration form. Therefore, the enterprise only needs to fill in consistently and synchronously with the previously declared data, avoiding discrepancies between the two declaration forms.

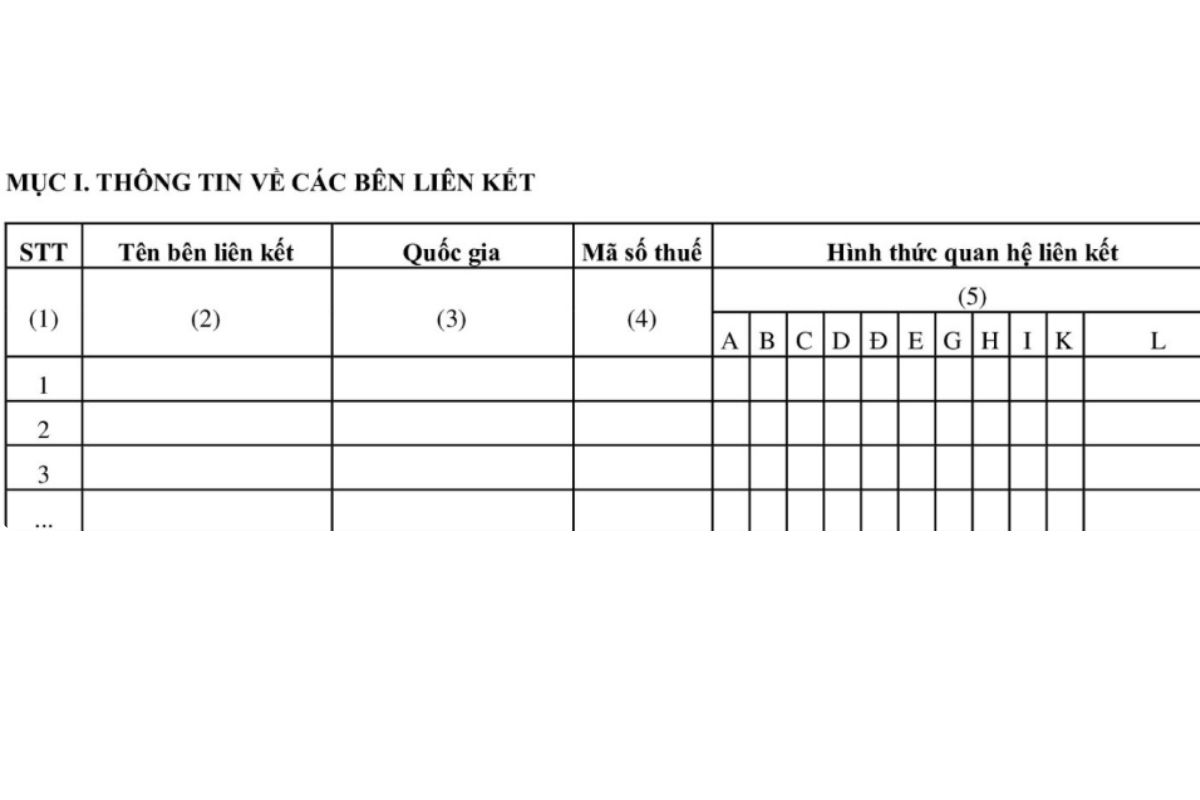

Section I: Information about Affiliated Parties

The information in this section of the Related Party Transaction Declaration Form applies only to related parties that have related party transactions with the enterprise, in accordance with the provisions of Clause 3, Article 4 of Decree 20/2017/ND-CP.

Column (2): Businesses need to accurately identify the Affiliate and fill in the correct name as it appears on legal documents.

- When declaring affiliated parties in Vietnam, businesses must correctly state the organization's name as stated in their Business Registration Certificate. All information must match legal data to ensure accuracy and avoid errors during verification by the Tax Authority.

- If the partner is an individual, the business needs to record the information based on valid identification documents, such as a Citizen Identity Card or Passport.

- If the Affiliate is a foreign individual or organization, the business must correctly state the legal name as shown in the documents proving the affiliation. This includes documents such as the Business Registration Certificate, cooperation agreement, affiliation agreement, or any other legal documents demonstrating the relationship between the business and the Affiliate.

Column (3): State the name of the country or territory where the Affiliated Party is a resident.

Column (4): Enter the tax identification numbers of the affiliated parties:

- If the affiliated party is a domestic organization or individual, the business must declare the full tax identification number as stated on the tax registration certificate.

- If the affiliated party is an organization or individual located abroad, the business must provide the corresponding tax identification number or identifier when filing the tax return. If the affiliated partner does not have a tax identification number, a specific reason must be stated so that the Tax Authority can review and verify the information.

Column (5): According to Clause 2, Article 5 of Decree 20/2017/ND-CP, businesses must select and mark all boxes that accurately represent each related-party relationship. Checking all relevant boxes correctly helps tax authorities accurately identify the nature of the related-party relationship and ensures that the declared information reflects reality.

Section II: Cases exempt from the obligation to declare and submit Transfer Pricing Documentation.

In Section II of the Related Party Transaction Declaration, if the enterprise falls under one of the cases exempted from declaration or exempted from preparing the Related Party Transaction File according to Article 11 of Decree 20/2017/ND-CP, it is only necessary to record the exemption code in Column (2) and then mark “x” in the corresponding box in Column (3) to confirm the exemption.

In the case where the enterprise is exempt from declaration according to Clause 1, Article 11 of Decree 20/2017/ND-CP, the enterprise only needs to select the corresponding box in Column (3) on the Declaration Form. Once it has been determined that it is exempt, the enterprise does not have to continue preparing the contents in Section III and Section IV of the Related Party Transaction Declaration Form.

See details: Instructions for declaring related-party transactions on HTKK (Vietnam Tax Declaration System).

For businesses exempted from preparing Transfer Pricing Documentation under point a or point c, Clause 2, Article 11 of Decree 20/2017/ND-CP, the declaration obligation is not completely waived. Businesses must still fully complete Sections III and IV of the Transfer Pricing Declaration Form, following the instructions in sections d.1 and e, to ensure data transparency and accuracy.

For cases exempted under point b, businesses must still file declarations, but the method of filing will follow the separate instructions in points 2 and e of the form.

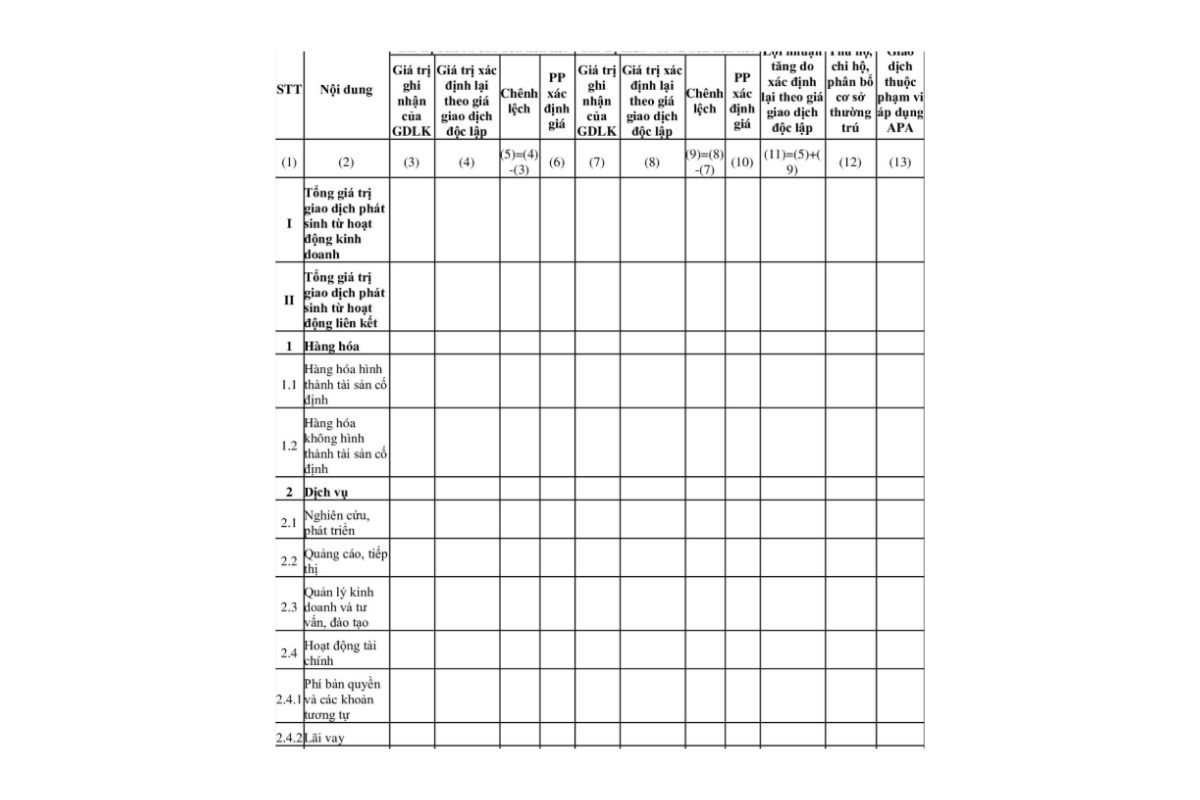

Section III: Information on determining transfer pricing

According to regulations on managing related-party transactions, enterprises that are exempt from preparing a Price Determination Document under point a or point c, Clause 2, Article 11 of Decree 20/2017/ND-CP must indicate this exemption directly on the Related-Party Transaction Declaration. Specifically, the enterprise must mark and declare in the corresponding section to confirm that it meets the conditions for exemption from preparing the document as prescribed.

- Columns (3), (7) and (12): Fill in the instructions in section d.2 of this Appendix.

- Columns (4), (5), (6), (8), (9), (10) and (11): Taxpayers leave blank and do not declare.

Unless it falls under the cases mentioned above, this section of the Related Party Transaction Declaration must be declared as follows:

Total value of transactions arising from business operations.

- Column (3): Fill in the total sales revenue for Affiliated Parties and Independent Parties.

- Column (7): Fill in the total cost payable to Affiliated Parties and Independent Parties.

- Columns (4), (5), (6), (8), (9), (10), (11), (12) and (13): Leave blank.

Total transaction value arising from related party activities

In Columns (3), (4), (7) and (8): Fill in the total value in the appropriate cells for each Goods plus (+) Services indicator.

Indicator (1), Column (3), (4), (7) and (8): Record the total value of Goods that form Fixed Assets + Goods that do not form Fixed Assets.

Indicator (2), Columns (3), (4), (7) and (8): Record the total value of “Research and development” + “Advertising, marketing” + “Business management and consulting, training” + “Financial activities” + “Other services”.

Section IV: Business Performance Results

When filing tax returns, businesses should pay particular attention to the information required in Section IV of the Related-Party Transaction Declaration Form, as this section directly reflects the nature of the transaction and the level of compliance. Some important points that businesses should not overlook include:

- If the enterprise has signed an APA (unilateral, bilateral or multilateral) with the Tax Authority, you need to mark “Yes” in the Related Party Transaction Declaration. Conversely, if the enterprise does not have an APA, just select “No” and leave the corresponding indicators in Column (4) in the business results table blank; this section does not require any additional information.

- In the case where the enterprise only has transactions with independent parties, the revenue information only needs to be recorded in Column (6) in the business results table. The subsequent declaration will be made according to the instructions corresponding to each type of enterprise as detailed in the attached Appendix.

For taxpayers in the manufacturing, trade, and service sectors.

The ratio of interest expense to net operating profit plus interest expense plus depreciation expense.

When the enterprise has marked "x" in Column (3), line 2a in Section II on the Related Party Transaction Declaration, the content to be completed will be declared according to the instructions below:

Closed indicators (1), (2), (3), (4), (5), (6), (7), (8), (8.1), (9), (9.1), (10), (11), (12), (13) and (14):

- Columns (3), (4) and (5): Leave blank

- Column (6): Record the value determined from the Financial Statement data.

- Line item (15): Leave blank

If the enterprise has selected and marked “x” in Column (3), line 2c in Section II on the Related Party Transaction Declaration, then the actual declaration should be made according to the following instructions:

The criteria in lines (1), (2), (3), (4), (5), (6), (7), (8), (8.1), (9), (9.1), (10), (11), (12), (13) and (14):

- Columns (3), (4) and (5): Leave blank

- Column (6): Record the value determined from the Financial Statement data.

Indicator 17 quintals, Section II in the Related Party Transaction Declaration:

- Column (2): Record the net profit margins before deducting interest expenses and corporate income tax on net revenue in the indicator lines (15).

- Columns (3), (4) and (5): Leave blank.

- Column (6): Taxpayers declare the net profit margin value before deducting interest expenses and corporate income tax on net revenue.

If a business is not exempt from preparing a Price Determination File, it must declare the Related Party Transactions Declaration as follows:

Criterion 1:

- Columns (3) and (4): Record the total value of transactions supplying goods and services to related parties to determine prices according to the Pricing Documentation in Column (3) and according to the APA in Column (4).

- Column (5): Record the total value of transactions supplying goods and services to independent parties according to the value recorded in the Accounting Book.

- Column (6): Record the total value determined according to the formula in Form 01 Appendix issued with Decree 20/2017/ND-CP.

Indicators 1 and 2: Taxpayers declare corresponding sales revenue and service provision revenue and record it according to the same instructions as in the Sales Revenue and Service Provision indicator.

Criterion 3: Columns (3), (4), (5) and (6): Record the value equal to the corresponding value in each column in Criterion 1 (except for Criterion 2).

Criterion 4:

- Columns (3) and (4): Record the total value of the cost of goods sold, determined by the value arising with related parties according to the Pricing Documentation and APA together with the value of transactions arising with independent parties recorded in the Accounting Book.

- Column (6): Record the total value determined by the calculation formula in the Related Party Transaction Declaration.

Criterion 5:

- Columns (3), (4), (5) and (6) have values equal to indicator 3 minus indicator 4.

Indicators 6 and 7:

- Columns (3) and (4): Record the total value equal to the total value arising with related parties according to the Pricing Documentation and APA plus the transaction value arising with independent parties recorded in the Accounting Book.

- Column (5): Record the total value similar to Columns (3) and (4).

- Column (6): Record the total value determined by the calculation formula in the Related Party Transaction Declaration.

Criterion 8:

- Columns (3), (4) and (5): Leave blank

- Column (6): Record the total value of financial operating revenue

Indicator 9:

- Columns (3), (4) and (5): Leave blank

- Column (6): Record the total value of the cost of goods sold, determined by the value arising with related parties according to the Pricing Documentation and APA together with the value of transactions arising with independent parties recorded in the Accounting Book.

Indicator 10:

- Columns (3), (4) and (5): Leave blank

- Record the total value of financial operating revenue.

Item 11: Record the value of interest expense included in financial expenses for the period.

- Columns (3), (4) and (5): Leave blank

- Column (6): Record the total value of the cost of goods sold, determined by the value arising with related parties according to the Pricing Documentation and APA together with the value of transactions arising with independent parties recorded in the Accounting Book.

Indicator (12): Columns (3), (4), (5) and (6) record values equal to indicator 11 (excluding indicator 8 and indicator 9).

Item 13: Record the value of interest expense included in financial expenses for the period.

- Columns (3), (4) and (5): Leave blank

- Column (6): Record the value equal to the value of the Net Profit from Business Operations indicator plus the Interest Expense indicator and the Depreciation Expense indicator.

Expenditure 16:

- Columns (3), (4) and (5): Leave blank

- Column (6): Record the value equal to the value of the Net Profit from Business Operations indicator plus the Interest Expense indicator and the Depreciation Expense indicator.

Indicator 17:

- Column (2): Record the net profit margins applied for adjustment.

- Columns (3) and (4): Record the profit margin value used to determine the price according to the Price Determination Document in Column (3) and according to the APA in Column (4).

- Columns (5) and (6): Leave blank.

For taxpayers in the Banking and Credit sectors.

Screeshot

Criterion 1:

- Columns (3), (4) and (5): Fill in the total value of interest income and similar income from related parties not signing the APA determined according to the Pricing Documentation in Column (3), according to the APA in Column (4) and according to the book value arising with the independent party in Column (5).

- Column (6): Record the total value determined by the calculation formula in the Related Party Transaction Declaration.

Criterion 2:

Columns (3), (4) and (5): Record the total value, determined by the following formula:

Total value = Total generated value + generated transaction value |

In Column (6), record the total value determined according to the calculation formula in the Related Party Transaction Declaration.

Criterion 3: Columns (3), (4), (5) and (6) have values equal to the corresponding values in each column of Criterion 1 minus Criterion 2.

Item 4: Fill in according to the same instructions as in Item 1.

Item 5: Fill in according to the same instructions as in Item 2.

Indicator 6: Columns (3), (4), (5) and (6) record the value equal to indicator 4 minus indicator 5.

Indicators 7, 8, and 9: Fill in according to the same instructions as for indicator 1.

Item 10: Fill in according to the same instructions as in Item 1.

Indicator 11: Fill in according to the same instructions as in Indicator 2.

Indicator 12: Columns (3), (4), (5) and (6) record the value equal to indicator (10) minus indicator 11.

Item 13: Fill in according to the same instructions as in Item 1.

Indicator 14: Fill in according to the same instructions as in Indicator 2.

Indicator 15:

- Columns (3), (4) and (5): Record the total value of credit risk provision costs corresponding to income and revenue-related items in Columns (3), (4) and (5) that are provisioned.

- Column (6): Record the total value determined by the calculation formula in the Related Party Transaction Declaration.

Indicator 16: Columns (3), (4), (5) and (6) record the value equal to the corresponding value in each column at indicator 3 + 6 + 7 + 8 + 9 + 12 + 13 – 14 – 15.

Indicator 17: Columns (3), (4), (5) and (6) record the value equal to indicator (16) minus indicator (12).

Indicator 18:

- Column (2): Record the adjusted profit margins, determine the transfer pricing in the indicator lines (15) corresponding to the transfer pricing method.

- Columns (3) and (4): Record the profit margin value applied to determine the price according to the Price Determination Document in Column (3) and according to the APA in Column (4).

This applies to cases where the taxpayer is a securities company or a securities investment fund management company.

Screenshot

If the taxpayer has declared in Column (3) in line 2a Section II of the Related Party Transaction Declaration, then declare according to the following instructions:

The indicators for lines (1) to (4):

- Columns (3), (4) and (5): Leave blank

- Column (6): Value determined from the Financial Statements.

Line criterion (15): Leave blank.

With all the analysis and guidance above, it can be seen that Declaration of related-party transactions It demands precision and consistency in every minute detail.

Download the Related Party Transaction Declaration form:

| Related Party Transaction Declaration |

Conclude

Completing and filing the Related-Party Transaction Declaration requires businesses not only to correctly understand the regulations but also to ensure consistency between the data, pricing records, and actual operations. Even a small error in marking selections, determining exemption thresholds, or presenting information can significantly increase the risk of being audited, assessed, and having taxes collected.

If your business needs to review its current filing procedures, optimize compliance, or prepare documentation in accordance with legal regulations, MAN – Master Accountant Network is always ready to support you with our team of experienced experts. A brief discussion can help your business immediately identify potential risks and find the most suitable solutions. Contact us for timely and secure support before any tax audit.

Contact information MAN – Master Accountant Network

- Address: No. 19A, Street 43, Tan Thuan Ward, Ho Chi Minh City

- Mobile/Zalo: 0903 963 163 – 0903 428 622

- Email: man@man.net.vn

Content production by: Mr. Le Hoang Tuyen – Founder and CEO of MAN – Master Accountant Network, CPA Vietnam with over 30 years of experience in accounting, auditing, and financial consulting.

Editorial Board of MAN – Master Accountant Network