How to calculate related-party transaction tax is a core issue that all businesses with related-party relationships must master to avoid the risk of additional collection, late payment penalties and tax assessment from tax authorities. In the context Decree 132/2020/ND-CP continue to be strictly applied, understanding the legal regulations, pricing methods, independent transaction principles, how to calculate EBITDA to control interest expenses and the requirements of Pricing Documents such as Local File, Master File and CbCR becomes a vital factor. This article provides you with accurate, updated and in-depth knowledge to help businesses proactively control risks, optimize taxes and establish a systematic, clear and immediately applicable transfer pricing compliance strategy.

What is affiliate trading?

According to Clause 22, Article 3 of the Law on Tax Administration 2019, related-party transactions are transactions arising between related parties in the process of production and business. These transactions include buying, selling, exchanging, renting, leasing, borrowing, lending, transferring, assigning goods, providing services, borrowing, lending, financial services, financial guarantees and other financial instruments.

Management objectives:

- Preventing BEPS: Businesses often tend to shift profits from high-tax countries to low-tax or no-tax countries through non-market pricing (e.g., buying raw materials from the parent company at very high prices, or selling to subsidiaries at very low prices). This erodes the corporate income tax (CIT) base in Vietnam.

- Ensuring fairness: Ensure that transactions between related parties are priced correctly according to the Arm's Length Principle, equivalent to transactions between unrelated parties in the market.

Core legal basis Decree 132/2020/ND-CP

All current regulations on the calculation of related-party transaction tax and tax management are mainly stipulated in Decree No. 132/2020/ND-CP of the Government. This Decree replaces previous regulations, providing detailed guidance on identifying related parties, pricing methods, and important cost adjustments.

In order for tax authorities to be able to carry out management work and ensure compliance with the principle of independent transactions, Decree 132 has provided clear criteria to accurately determine the scope of entities considered to have related relationships.

What are Affiliated Parties?

This is the first and most important step in determining whether a business is subject to the regulations on how to calculate related-party transaction tax.

According to Article 5, Decree 132/2020/ND-CP, there are 8 main cases that determine the parties having an affiliated relationship. The following are the most common cases:

“An enterprise directly or indirectly holds at least 25% of the capital contribution of the owner of the other enterprise;

Both enterprises have at least 25% of owner's equity held directly or indirectly by a third party;

One enterprise is the largest shareholder in terms of equity and directly or indirectly holds at least 10% of the total shares of the other enterprise;

An enterprise guarantees or lends capital to another enterprise in any form (including loans from third parties secured by the financial resources of the related party and financial transactions of a similar nature) on the condition that the loan amount is at least equal to 25% of the capital contribution of the owner of the borrowing enterprise and accounts for more than 50% of the total value of the medium- and long-term debts of the borrowing enterprise;

An enterprise appoints a member of the executive board or controlling authority of another enterprise provided that the number of members appointed by the first enterprise accounts for more than 50% of the total number of members of the executive board or controlling authority of the second enterprise; or a member appointed by the first enterprise has the right to decide on the financial policies or business activities of the second enterprise;

Two businesses have more than 50% members on the board of directors or have one member on the board of directors with the right to decide on financial policies or business operations appointed by a third party;

Two enterprises are operated or controlled in terms of personnel, finance and business operations by individuals in one of the following relationships: husband and wife; biological parents, adoptive parents, stepfathers, stepmothers, parents-in-law; biological children, adopted children, stepchildren of the wife or husband, daughters-in-law, sons-in-law; full siblings, half siblings, half siblings, brothers-in-law, sisters-in-law of the same parents or half siblings, paternal grandparents, maternal grandparents; paternal grandchildren, maternal grandchildren; paternal aunts, paternal uncles, paternal uncles, paternal uncles and paternal nieces and nephews;

Two business establishments have a head office and permanent establishment relationship or are both permanent establishments of foreign organizations or individuals;

Enterprises controlled by an individual through the individual's capital contribution to that enterprise or direct participation in the operation of the enterprise;

Other cases in which an enterprise is subject to the actual management, control and decision-making of the production and business activities of the other enterprise;

The enterprise has transactions of transferring or receiving the transfer of at least 251,0 ...

Source: Law Library

Detailed instructions on how to calculate related transaction tax

The calculation of related-party transaction tax is essentially the process of adjusting the taxable income of associated enterprises so that the profit recorded in Vietnam accurately reflects actual economic activities and complies with the principle of independent transactions.

This process consists of two main parts: Price Determination and Adjustment (for all transactions) and Interest Expense Adjustment (for borrowing transactions).

Determining price according to the Independence Principle

To find the market price for a related party transaction, tax authorities and enterprises must apply one of the following three methods:

Comparable Uncontrolled Price (CUP) Method

Compare the selling or purchasing price of a product or service in an affiliated transaction with the price of a similar product or service in an independent transaction.

Most appropriate when the products, contract terms and market conditions of the associated and independent transactions are nearly identical (little or no material difference).

- Advantages: Provides the most direct and clear evidence of price independence.

- Challenge: It is difficult to find completely equivalent independent transactions, especially for specialized goods or exclusive services.

Example: A steel manufacturing company sells raw steel to its parent (affiliated) company and to an independent (standalone) company. If the steel type, quantity, and delivery terms are the same, the selling price to the independent party is the market price used to compare with the selling price to the affiliate.

Gross profit margin comparison method

This method focuses on the profit margin earned from distribution or manufacturing activities.

| Method | Principle | Apply | Examples or notes |

| Resale Price Method (RPM) | Compare the gross profit margin of affiliate distributors with that of independent distributors. | Suitable for distribution companies, trading, buying and selling activities, not processing or creating high added value. | For example: Company A buys shoes from the parent company and resells them. A's gross profit margin should be within the range of independent shoe distributors. |

| Cost-to-Placement Method (CPM) | Compare the Cost Plus Margin of the related party, which is a manufacturer or service provider, with similar independent businesses. | Applicable to outsourcing manufacturers or service providers (R&D, IT, internal services). | Note: Popular with low-risk outsourcing manufacturing businesses. |

| Net profit margin method | Compare the net profit margin (ROS, ROTC…) of the associated enterprise with that of an independent enterprise with similar functions. | Most widely applied in Vietnam; suitable for many industries thanks to its high stability and low sensitivity to small differences in transactions. | Common comparison metrics: ROS (Return on Sales), ROTC (Return on Total Costs). |

From the table above, it can be seen that each method has its own scope of application and advantages, depending on the function, risk and operating model of the enterprise. Choosing the right comparison method not only helps the enterprise comply with the regulations on related-party transactions but also optimizes the profit level in accordance with the business reality. If the enterprise is confused in determining the optimal method, consider re-evaluating the function - risk to make the most accurate choice.

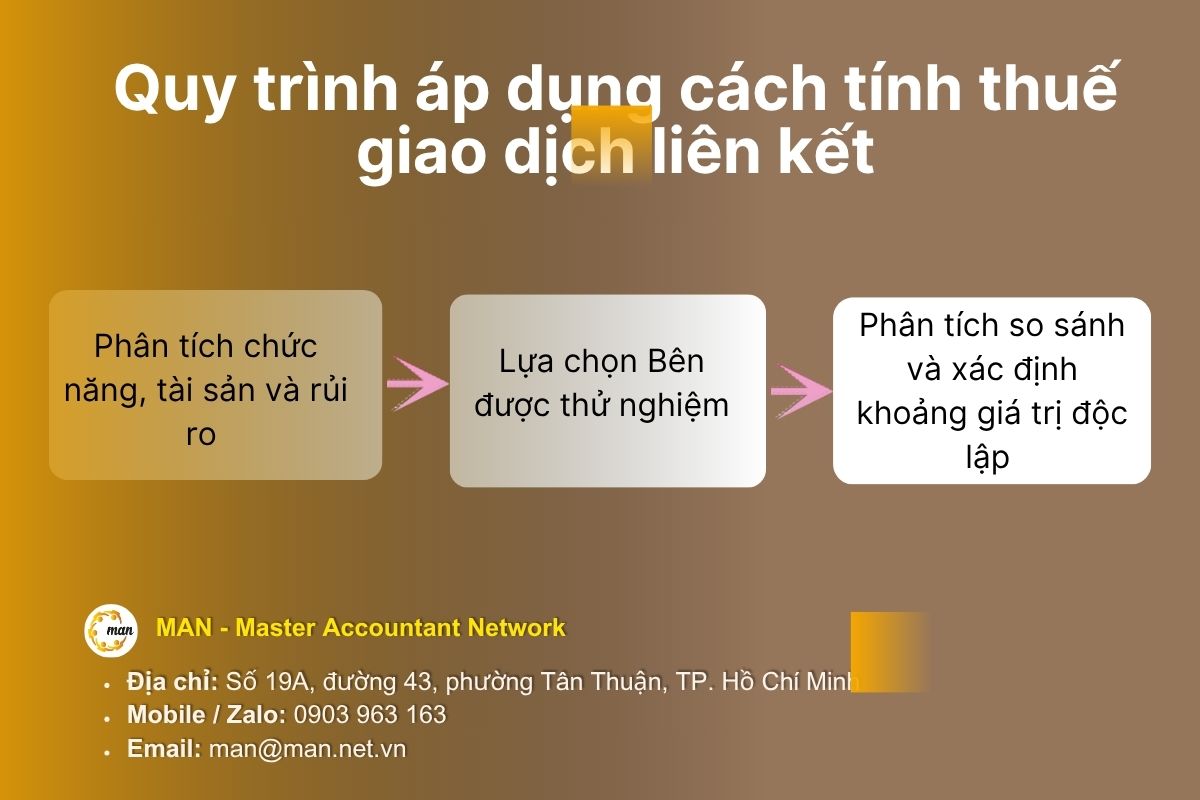

3-step process for applying the method of calculating related-party transaction tax

To determine the market price, businesses must carry out a rigorous analysis process:

Step 1: Functional, Asset and Risk Analysis (FAR Analysis)

This is a fundamental step, helping to accurately determine the role of affiliated enterprises in Vietnam:

- Functions: What functions does the business perform? (Production, distribution, research, marketing, assembly…).

- Assets: What assets does the business use? (Tangible assets, intangible assets, brands, technological know-how...)

- Risks: What risks does the business bear? (Market risk, inventory risk, credit risk, exchange rate risk...)

FAR analysis helps determine the reasonable profit level that a business should achieve.

Step 2: Select the tested side

After completing the FAR Analysis, the business needs to carefully select the test subjects and pricing methods according to the following factors:

- Tested Party: Is a party with simple functions, low risk and easy to find an independent party for comparison (usually a pure processing and distribution company in Vietnam).

- Method Selection: Based on FAR, select the most suitable method. For example, if you are a pure manufacturing company, CPM or TNMM (cost based) will be preferred.

Once the roles have been identified and the appropriate Tested Party and methodology selected, the next step is to go about finding comparable independent entities and establishing market value ranges.

Step 3: Perform comparative analysis and determine independent value ranges

Once the FAR Analysis has been completed and the appropriate method has been selected, the business proceeds with the following steps to establish the market price:

- Search for comparable companies with similar functions, risks, and assets.

- Calculate the profitability metrics (e.g., ROS, ROTC) of these independent companies to establish the Arm's Length Range.

- Price adjustment: If the profit margin of the associated enterprise falls outside this Independent Value Range (from the 35th percentile to the 75th percentile), the enterprise must automatically adjust its CIT taxable income to the median of this range.

However, ensuring transactions are independent is only part of the calculation of related-party transaction tax. To complete the determination of taxable income, enterprises must also comply with other mandatory cost control regulations under Decree 132/2020/ND-CP, especially for loans.

Mandatory adjustments directly affect the calculation of related-party transaction tax

After determining the transfer pricing based on the independence principle, enterprises must consider other mandatory adjustments applied by tax authorities, especially regulations on interest expense in related party transactions.

Limit on interest expenses

This is a key regulation, designed to control profit shifting through internal loans.

Decree 132/2020/ND-CP stipulates that deductible interest expenses when calculating corporate income tax must comply with the following limits:

- The total interest expense incurred during the period of the taxpayer is deductible when determining taxable income of CIT not exceeding 30% of the total Net operating profit of the period plus Interest expense and Depreciation expense incurred during the period (often referred to as EBITDA).

Control formula:

Maximum deductible interest expense ≤ 30% x (Net profit + Net interest expense + Depreciation expense) |

In there:

- Net profit: Is the profit from business activities during the period, excluding profits from other activities such as asset liquidation, year-end exchange rate differences, etc. (Usually taken as the indicator on the business results report).

- Interest expense: Is the interest expense after deducting deposit interest and loan interest incurred during the period.

- Depreciation expense: Is the total depreciation expense of fixed assets and intangible assets included in the period's expenses.

See details: How to calculate interest costs according to Decree 132

How to Calculate Transfer Tax: Documents, Procedures and Risks

Understanding how to calculate transfer pricing must go hand in hand with understanding the filing obligations and the risks of non-compliance.

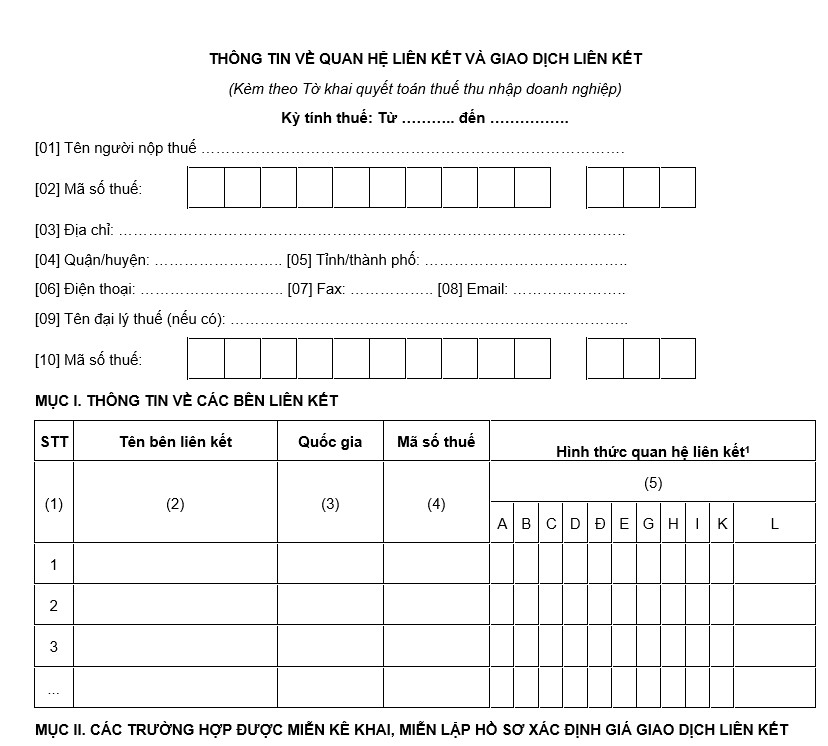

Annual mandatory reporting (Form 01)

All enterprises that have related-party transactions during the tax period (not exempted) must submit the Related-party Transaction Information Declaration according to Form No. 01 attached to Decree 132/2020/ND-CP.

- Content: Detailed declaration of related parties, types of transactions (purchase, sale, borrowing, services), and financial indicators related to determining transfer pricing.

- Submission deadline: At the same time as submitting the Corporate Income Tax Finalization Declaration (usually March 31 of the following year).

Prepare the Affiliate Transaction Documents

To prove that the transfer pricing complies with the independence principle, enterprises need to prepare a set of documents at 3 levels:

| File | Terms and conditions apply | Purpose |

| National Profile (Local File) | Mandatory for most businesses. | Provides detailed information on specific related party transactions in Vietnam and comparative analysis. |

| Global Profile (Master File) | Applies to multinational corporations with total global consolidated revenue exceeding the prescribed threshold. | Provides an overview of the Group's business operations, value chain and pricing policies. |

| Country-by-Country Profit Reporting (CbCR) | Applicable to multinational corporations with total global consolidated revenue of VND 18,000 billion or more. | Provides aggregate information on revenue, profits, taxes paid, and business activities by country. |

Note: The Related Party Transaction Profile must be completed and submitted at the same time as the Corporate Income Tax Finalization Declaration and be available within 15 working days upon request from the tax authority.

Consequences and risks of non-compliance

The biggest risk when a business does not clearly understand how to calculate related-party transaction tax or does not fully prepare documents is that the tax authority will set the related-party transaction price, leading to:

- Corporate Income Tax Collection: Tax authorities fix the selling price or purchase price, increasing the taxable profit of the enterprise.

- Administrative penalties: Administrative penalties for acts of false declaration, late submission or failure to prepare/complete incomplete records.

- Late payment penalty: Calculating late payment interest on the amount of corporate income tax that is collected, fined, or even taxed.

- Negative impact on reputation: Large tax arrears can affect a business's reputation and relationship with regulators.

See also: Time for preparing and submitting documents according to Decree 132/2020/ND-CP.

Conclude

Mastering the calculation of related party transaction tax along with preparing complete documents, procedures and managing compliance risks are key factors for businesses to avoid tax arrears, administrative fines and protect their reputation in the market. Correctly applying methods of determining prices, calculating EBITDA and preparing Local File, Master File and CbCR not only helps to comply with the law but also optimizes reasonable profits.

If your business needs detailed instructions on how to calculate related party transaction tax, check your records or want advice on the optimal method for each specific case, please contact us. Contact now Contact MAN – Master Accountant Network for the most dedicated and accurate support.

Contact information MAN – Master Accountant Network

- Address: No. 19A, Street 43, Tan Thuan Ward, Ho Chi Minh City

- Mobile/Zalo: 0903 963 163 – 0903 428 622

- E-mail: man@man.net.vn

Content production by: Mr. Le Hoang Tuyen – Founder & CEO MAN – Master Accountant Network, Vietnamese CPA Auditor with over 30 years of experience in Accounting, Auditing and Financial Consulting.

Editor MAN – Master Accountant Network